Property InvestmentProperty News

How Much Could You Save? Stamp Duty Changes Explained

In his Summer Statement last week, the Chancellor, Rishi Sunak, announced a wide range of measures designed to breathe life back into the flagging UK economy to counteract the ‘profound economic challenges’ the nation is experiencing as a result of the novel coronavirus pandemic sweeping across the globe.

In his speech, Sunak recognised the key part the housing sector would play in supporting the UK’s economic recovery and announced a temporary discount to England and Northern Ireland’s Stamp Duty Land Tax (SDLT) by increasing the tax threshold from £125k to £500k on a homebuyer’s main residence with immediate effect. This reduction means that people completing a home purchase during the SDLT discount period (between 8 July 2020 to 31 March 2021) won’t need to pay stamp duty on the first £500,000 of the purchase price, thereby giving homebuyers a significant discount on their house purchase costs with the average buyer benefiting from a £4,500 reduction in costs.

The temporary reduction in the SDLT tax, which will apply to both first time buyers (whose previous threshold was £300k) and those that have owned a property before, will come as a welcome relief for homebuyers in England and Northern Ireland as nearly nine out of ten people buying a main residence will pay no stamp duty at all while others buying properties above the £500k threshold will only pay SDLT on the purchase cost above £500 rather than above the previous threshold of £125k. For example, a person buying a house for £800,000 will save close to £15,000 on their purchase costs!

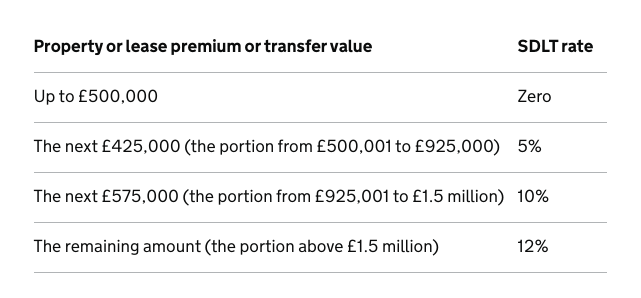

Table 1. Residential rates on purchases in England and N. Ireland from 8 July 2020 to 31 March 2021 (including First Time Buyers)

Table 1. Source gov.co.uk

Sunak said: “Right now, there is no stamp duty on transactions below £125,000. Today, I am increasing the threshold to half a million pounds. This will be a temporary cut running until 31st March next year. The average stamp duty bill will fall by £4,500.”

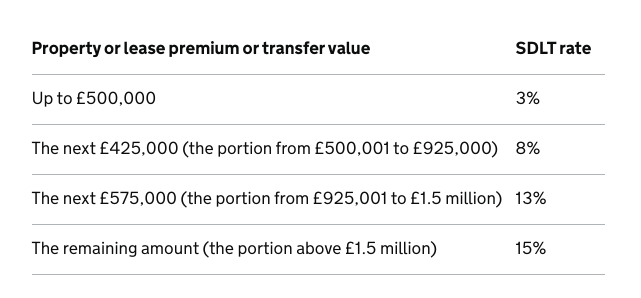

STLT Rates for additional properties in England and N. Ireland

Property investors buying a second or further additional properties in England and Northern Ireland above £40,000 will also benefit from the changes paying just 3 per cent SDLT on purchases up to £500,000 until the discount period ends on 31 March 2021 (see table 2).

Table 2: Regional Breakdown of Property Purchases (All Buyers)

The government says that companies and individuals buying residential property worth less than £500,000, will also benefit from these latest changes, as will companies that buy residential properties of any value where they meet the relief conditions from the corporate 15 per cent SDLT charge.

Industry Reaction

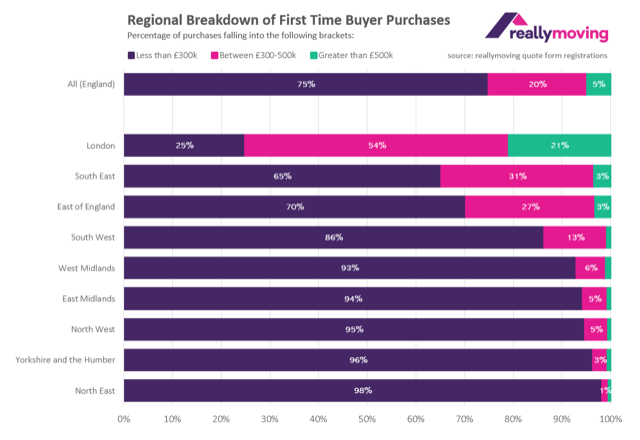

Out of all buyers across England, including first-time buyers and those buying and selling, home moving services platform reallymoving calculated that 91.3 per cent of homebuyers will be stamp duty free, with only 8.7 per cent being liable to pay the costly property tax.

Table 3: Regional Breakdown of Property Purchases (All Buyers)

Rob Houghton, CEO of reallymoving, said: “This tax giveaway could have a significant impact on the market, particularly in more expensive locations such as London, where the majority of First Time Buyers have still been liable to pay stamp duty, and the South East.”

Richard Donnell, Research and Insight Director at Zoopla concurred that the immediate increase in the stamp duty threshold would help sustain the rebound in housing market activity, saying: “The benefits will be immediate; nine of ten transactions in England will no longer be subject to the tax and in London and the South East, home to more expensive properties, homebuyers can save up to £14,999 overnight.”

James Forrester, Managing Director of independent lettings and estate agent Barrows and Forrester based in Birmingham was impressed by the Chancellor’s decision to cut SDLT: “A bold move by the chancellor today and one that will no doubt stoke the fires of homebuyer demand with such a large proportion of those transacting due to benefit.”

Further measures to energise the market

Sunak also announced further measures to bolster the hard-hit property market, including:

- a new, £2 billion Green Homes Grant. From September, homeowners and landlords will be able to apply for vouchers to make their homes more energy-efficient. The grants will cover at least two-thirds of the cost, up to £5,000 per household and up to £10,000 for low-income households

- and a £50 million fund to pilot the right approach to decarbonising social housing, a policy critical to achieving the government’s ambition of net-zero carbon emissions by 2050

Ben Beadle, Chief Executive of the National Residential Landlords Association, welcomed the new Green Homes Grant facility: “Improving the energy efficiency of rental housing is good news for tenants, landlords and local economies. We encourage all landlords to make use of this as it will mean housing standards are improved, tenants will save money and it will reduce carbon emissions across the whole sector.”

Mark Hayward, Chief Executive, NAEA Propertymark praised Sunak’s new measures saying that they would: “enable people looking to buy a home to have the confidence and stability to be able to move forward with their purchase, which in turn will have a knock-on effect on the wider economy as people buy white goods and furniture”.

Devolved Nations

The SDLT equivalents in Scotland and Wales have also seen their land duty tax thresholds raised this week from £145,000 and £180,000 respectively to £250,000 in response to Sunak’s emergency SDLT cut announced last week. The main difference to the Land Transaction Tax in Wales to the other UK nations is that buyers of a second home or additional properties, such as buy-to-lets won’t benefit from the lower rates of tax on the standard Land Duty Tax meaning they will still have to pay 3 per cent of the total purchase price on properties costing more than £40,000.

Although the property market is performing well at the moment, the Chancellor knew that once all the government’s COVID-19 support measures were phased out, the property market might well have stalled again. So, it is great that the sector has given the support and tools it needs to recover, at least until April next year.