LatestProperty Investment

Revealed: The Football Stadium Towns Winning the Premier Property League

As the race to purchase Chelsea football club hots up, new research has revealed that its iconic stadium Stamford Bridge tops the Premier League Property table in relation to local property market values.

There has been no shortage of potential buyers in the running to buy the club since Roman Abramovich made the decision to step down after being hit with sanctions due to his ties to the Russian president Vladimir Putin. In fact, around 200 groups have expressed an interest in buying the club including the Saudi Media Company and the Ricketts family.

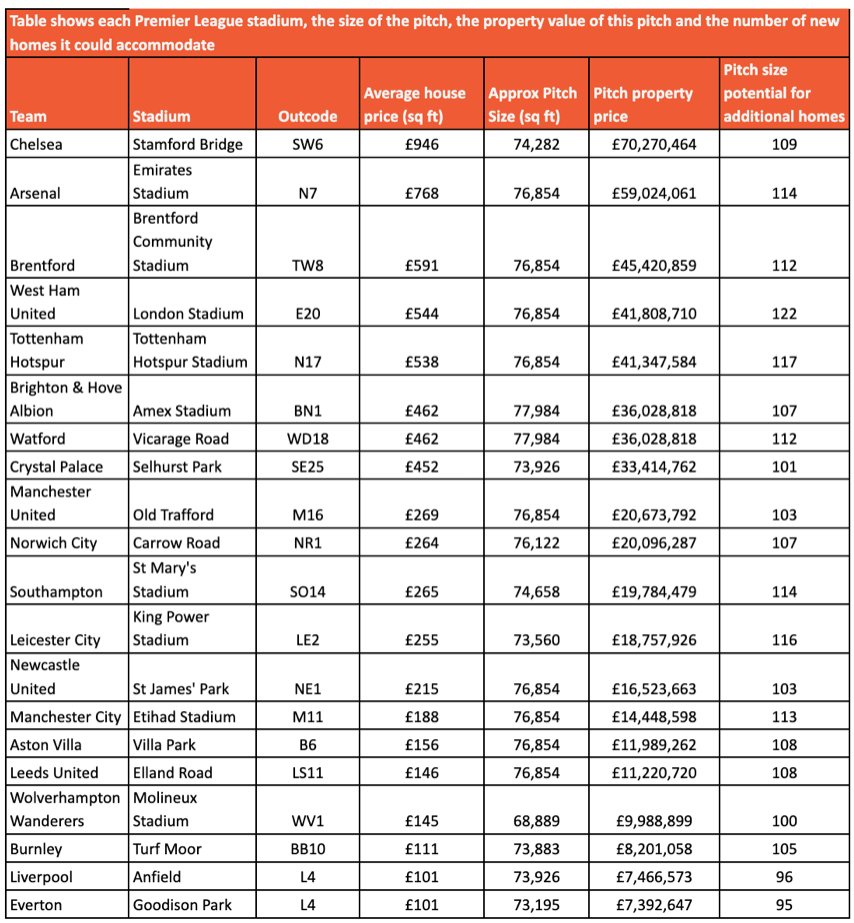

This new study looked at the square footage of every Premier League football pitch, what it amounts to in terms of current property market prices in each stadium postcode, and how many properties it might hold based on the average property size in each area.

According to the research, properties in the SW6 postcode where the stadium is located currently cost £946 per square foot on average. With the pitch itself spanning 74,282 square feet, this makes Stamford Bridge the most expensive stadium in the Premier League with a value of £70.27 million!

Arsenal’s Emirates Stadium sits second in the Premier property league in this respect, with the Emirates pitch worth £59m based on current market values in the N7 postcode.

Brentford (£45.4 million), West Ham (£41.8 million) and Tottenham (£41.3 million) are the next highest teams outside of London, with pitch property values of £36 million.

At the other end of the table, Everton’s current poor form also is reflected in the property market, with their pitch valued at just £7.4 million, while Liverpool’s pitch is also on the low side with a valuation of £7.5 million.

West Ham Tops the Property Premier League for the Most Houses that Could be Built

West Ham topped the standings in terms of the number of potential new homes that could be delivered to the local market by a single premier league pitch. With the average Newham home measuring 629 square feet, the London Stadium’s pitch could accommodate 122 residences.

Leicester (116 residences), along with Tottenham (117), Southampton (114), Arsenal (114) and Man City (114), also scored well in this category.

Takeovers Boost Local Property Prices

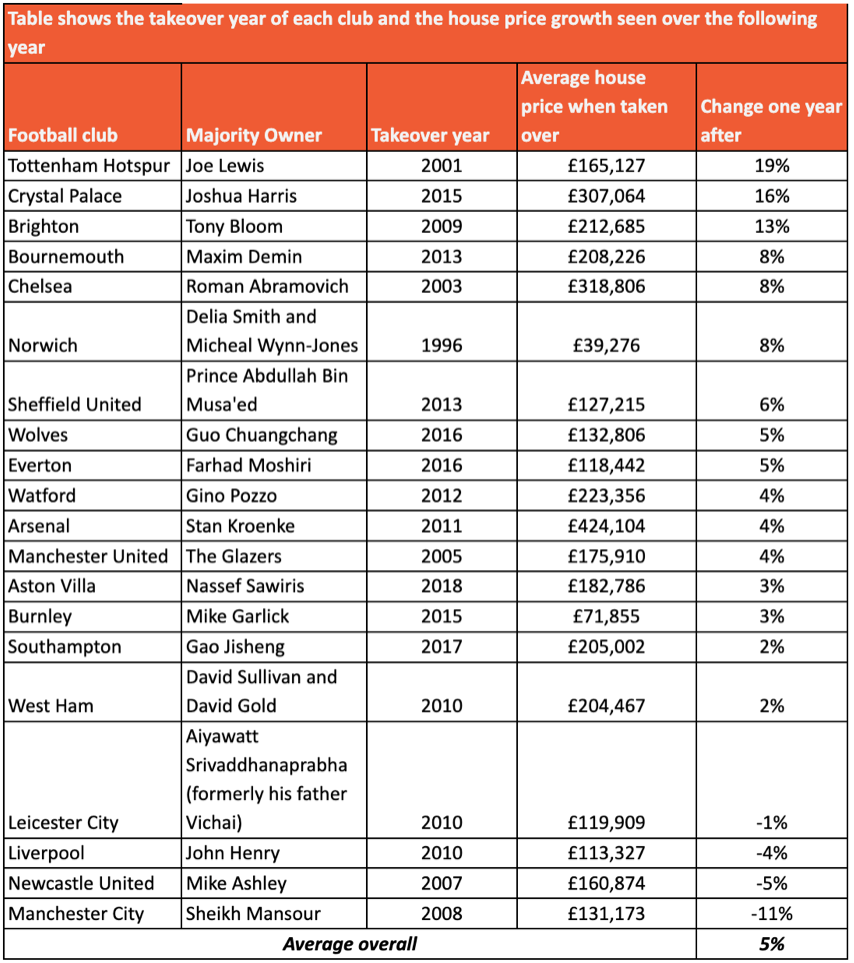

The research also looked at what the Stamford Bridge takeover could mean for the local property market with the results suggesting that property owners in SW6 could expect to see price rises following the takeover.

Analysing house price growth in 20 other Premier League stadiums following high-profile takeovers, the research found that on average, property values increased by five per cent, however, following Joe Lewis’ takeover of Tottenham in 2001, local house prices saw a 19 per cent increase. House prices also boomed by 16 per cent following Joshua Harris’ takeover of Crystal Palace in 2015, while there was a 13 per cent increase in local property values when Tony Bloom took over Brighton in 2009.

Colby Short Founder and CEO of GetAgent, which conducted the research, commented: “It’s fair to say that the purchase of Stamford Bridge is far from your average property purchase, particularly given the circumstances. But it certainly seems to be attracting a number of strong bids and who can blame them when the pitch alone is worth over £70m in local market values.

Of course, the football club itself is an integral part of the local community and its value stretches far beyond bricks and mortar or annual shirt sales, so let’s hope that whoever purchases it doesn’t intend to turn it into flats.”