Property InvestmentProperty News

Revealed: The Cheapest & Most Expensive Cities

Trying to decide whether it’s better to buy or rent a smaller property of two bedrooms or less can be difficult to calculate. However, a new study has sought to discover this data and has uncovered some fascinating contrasts in the prices that buyers and renters face across the country.

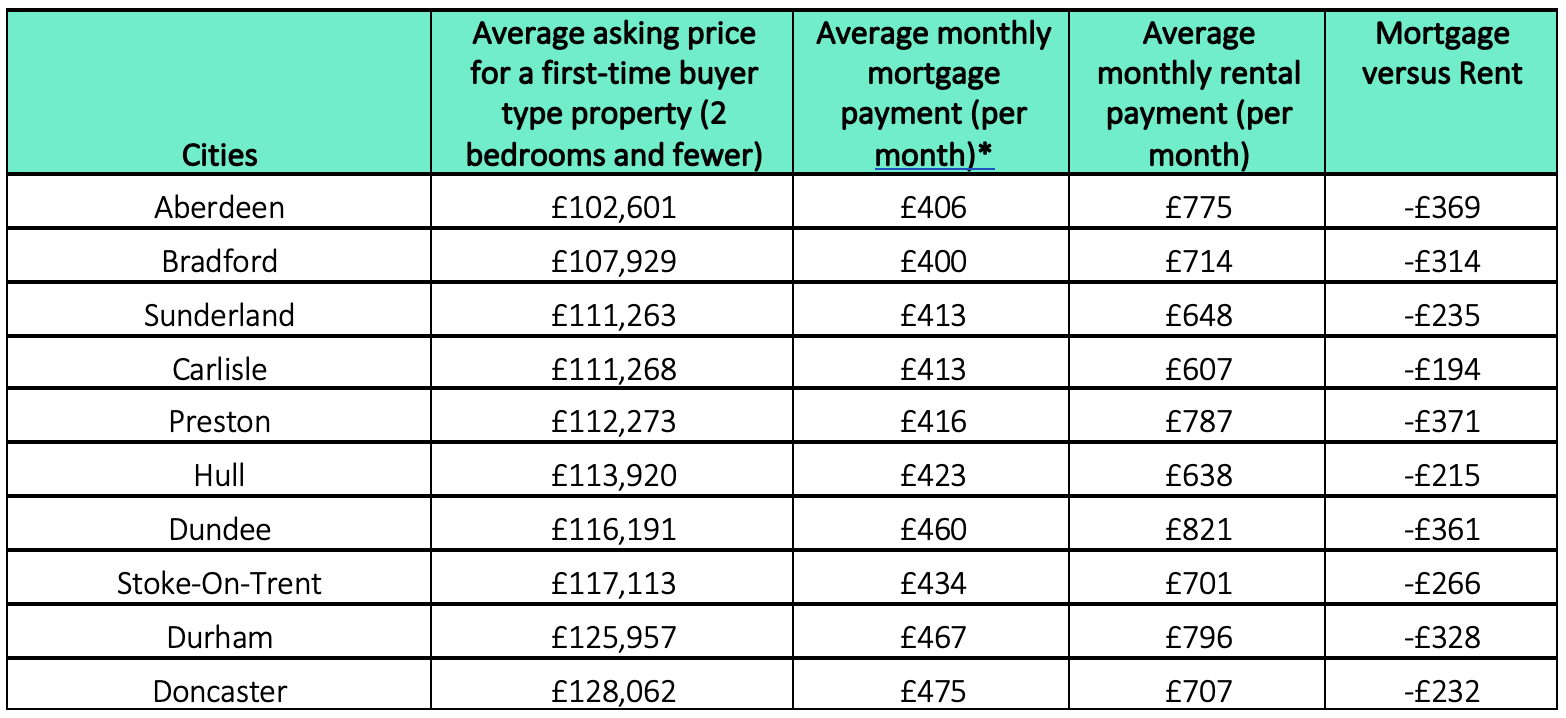

In the new analysis from Rightmove, Aberdeen has emerged as the most affordable city for those stepping onto the property ladder or buying a smaller property of two bedrooms or less. Aberdeen leads the way in the availability of first-time buyer-type properties with low average asking prices, typically featuring two bedrooms or fewer, with average prices running at just £102,601. This affordability is underpinned by an average monthly mortgage payment of just £406, assuming the buyers have saved a 20 per cent deposit and take out their mortgage on a 35-year term.

Bradford and Sunderland follow closely behind Aberdeen, offering buyers average asking prices of £107,929 and £111,263, respectively.

City Trends

Cheapest cities to buy

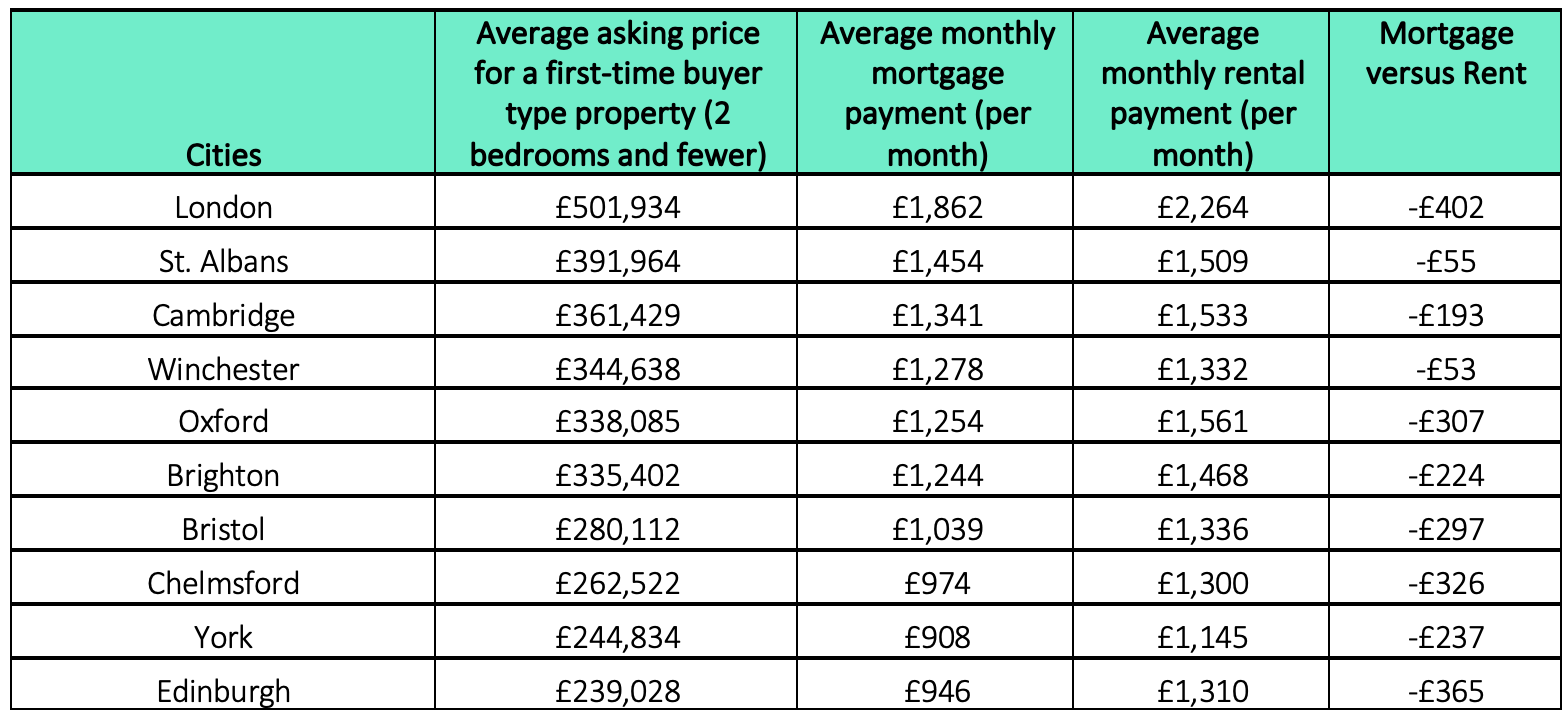

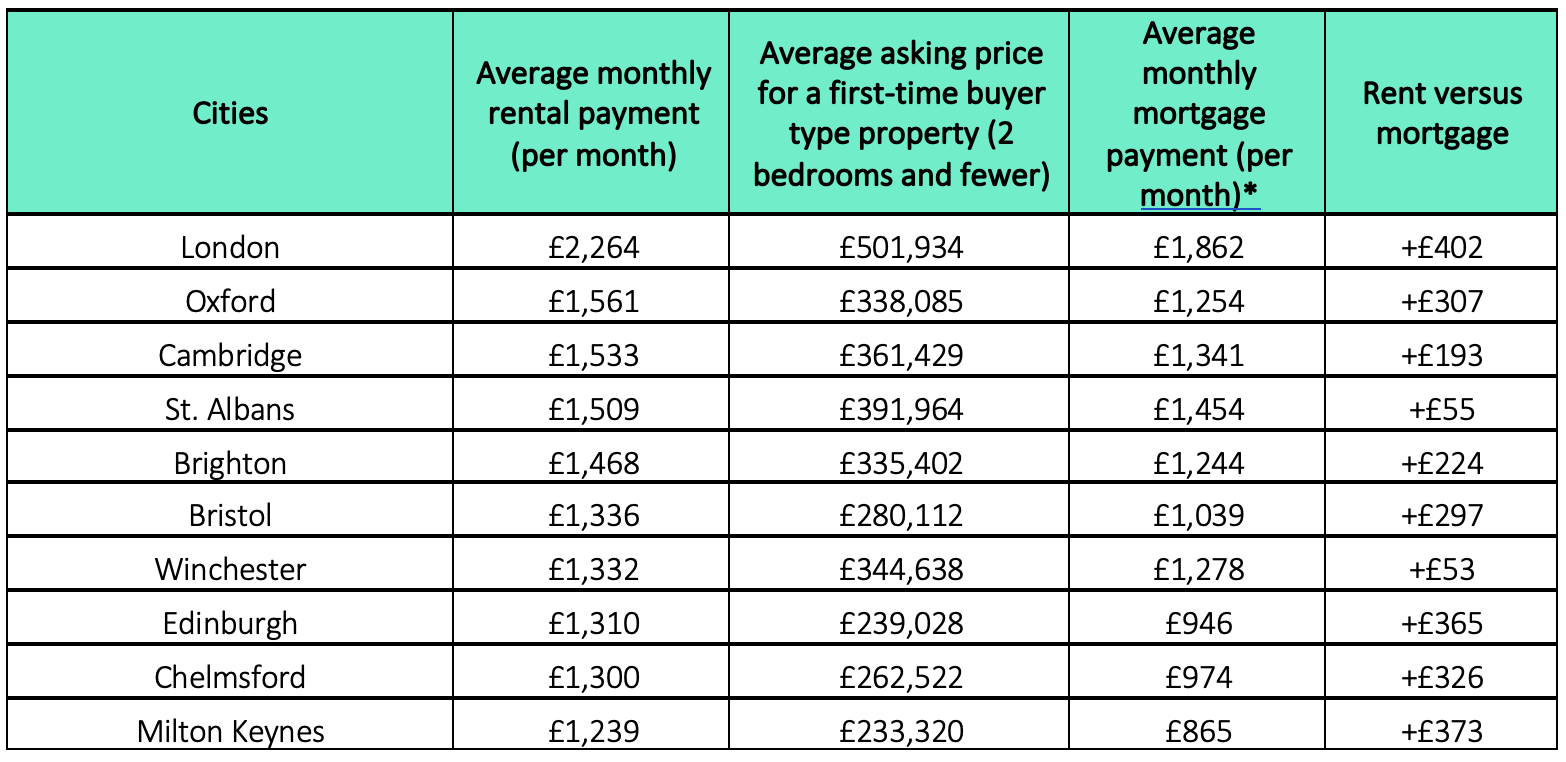

These cities represent significant opportunities for individuals looking to buy their first property without the hefty price tag associated with more expensive areas, such as London, where the average asking price for a first-time buyer is £501,934 with an average monthly mortgage payment of £1,862.

Most expensive cities to buy

St. Albans is the second most expensive city for buyers of smaller properties with two bedrooms or less costing an average of £391,964, followed by Cambridge (£361,429) and Winchester (£344,638), with Oxford (£338,085) making up the top five most expensive cities.

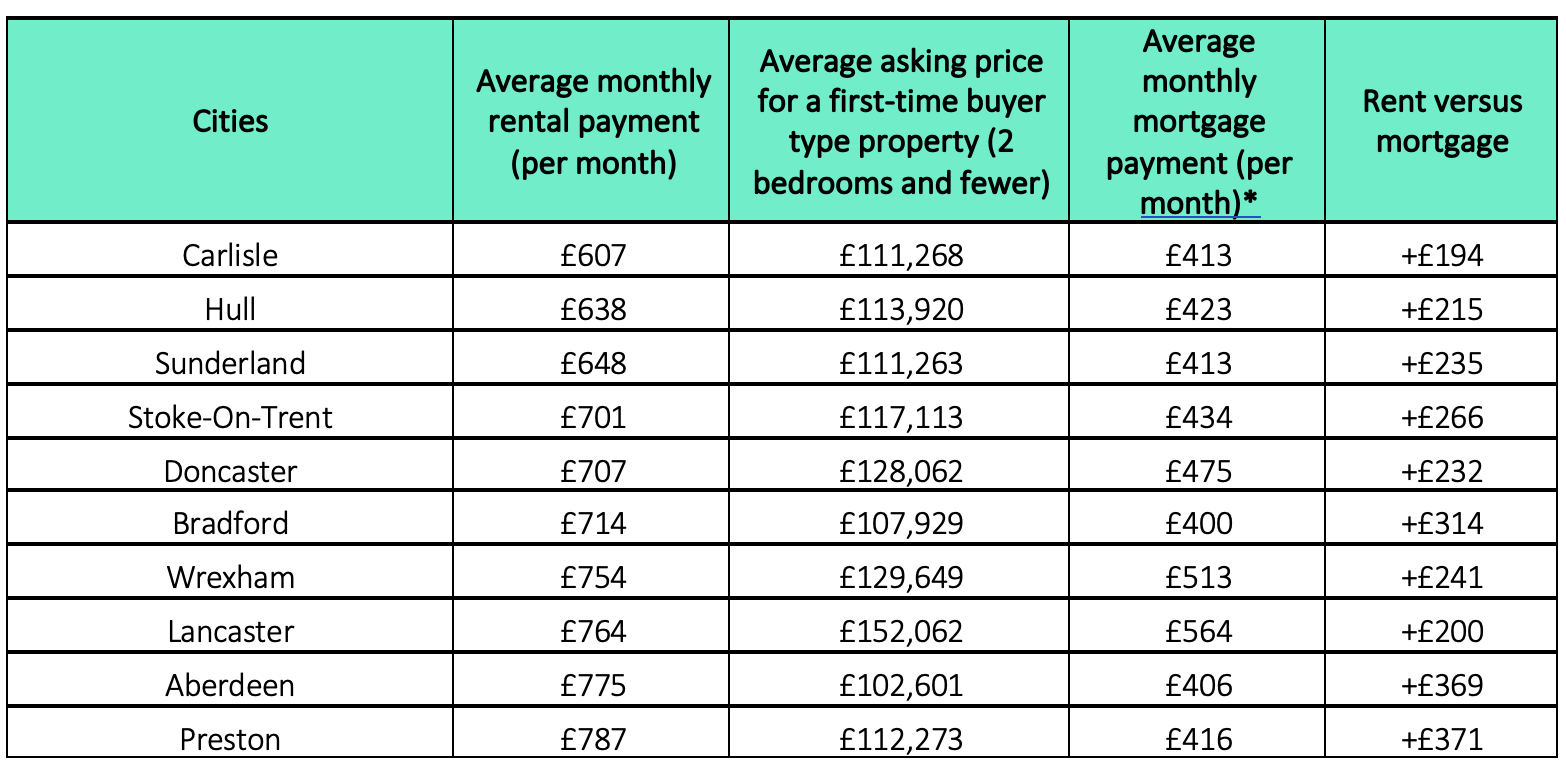

Carlisle claims the title of the cheapest city for renters, with an average rent for a comparable property of 2 bedrooms or less of £607 per month. Hull comes a close second with average rents coming in at £638 per calendar month (pcm), followed by Sunderland at £648pcm, Stoke-on-Trent at £701pcm and Doncaster at £707pcm.

Cheapest cities to rent

Unsurprisingly, London takes the top spot for the highest rents costing an average of £2,264pcm for a comparable property. Meanwhile, Oxford takes the top spot as the most expensive city outside of London, with average rents of £1,561 per calendar month for a similar-sized property. Cambridge (£1,533), St. Albans (£1,509) and Brighton (£1,468) also feature in the top five most expensive cities to rent.

Most expensive cities to rent

The analysis from Rightmove also sheds light on broader trends affecting both renters and buyers. Over the past year, the average monthly mortgage payment for typical first-time buyer properties in Great Britain has increased by £53, whereas rents have risen by £81. Despite these rises, purchasing remains more economical than renting in the majority of Britain’s largest cities, including the Capital, for those able to save up the average deposit of 20-25 per cent.

The research found that even for first-time buyers with a smaller 15 per cent deposit who want to repay their mortgage over the lower term of 25 years rather than 35 years, it is cheaper to pay a mortgage than rent in 39 out of Britain’s 50 largest cities outside of London.

Rightmove’s property expert Tim Bannister said: “These latest figures highlight why so many people remain determined to get onto the ladder. Longer mortgage terms are becoming more common as a way to improve overall affordability and reduce monthly payments, though buyers should be aware of what they are paying in interest compared with their actual mortgage. Without improvements to the supply of good quality, affordable rental homes in Great Britain, owning your own home is likely to continue to be the end-goal for those that can get their deposit together, and borrow what they need to from a mortgage lender.”

This new report serves as a useful guide for buyers looking to invest in smaller, first-time buyer-type properties.