Property InvestmentProperty News

Revealed: New UK Property Hotspots

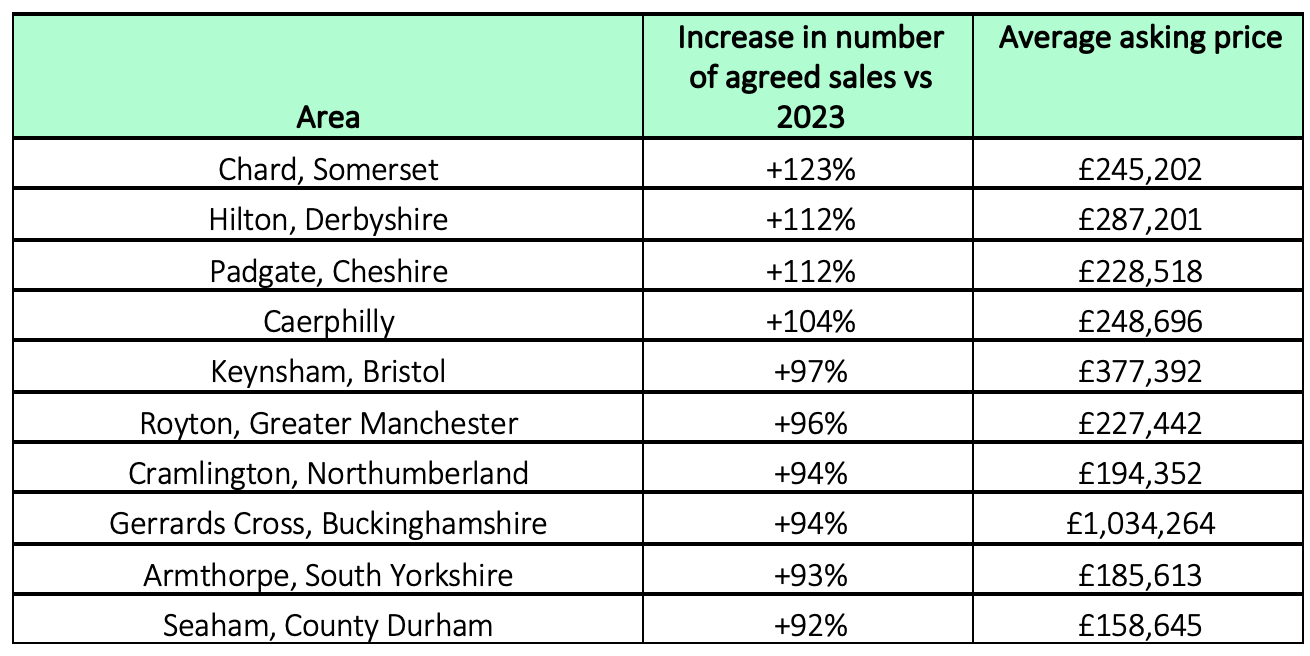

New research has revealed the UK’s newest property hotspots. Among these, a modest town in Somerset is leading the charge registering a remarkable 123 per cent uptick in property transactions. Meanwhile, detached homes are returning to popularity, reshaping the nation’s market dynamics.

The historic market town of Chard in Somerset, where an average property costs £245,202, has emerged as the leader of the latest property market hotspots, with statistics showing an impressive +123 per cent rise in the number of sales agreed compared to the same period last year.

Located close to the borders of both Devon and Dorset, Chard serves as the perfect gateway for exploring the West Country. The town also offers various attractions within a short drive from the town centre, ranging from historic houses and cider mills to animal sanctuaries and wildlife parks.

Hot on Chard’s heels are Hilton in Derby, where average house prices are £287,201, and Padgate in Warrington, where the average house price is £228,518. Both towns have witnessed a significant jump of 112 per cent in agreed sales, underscoring a broader trend of price increase activity across various locales.

Padgate, Cheshire, mirrors Hilton’s rise with a +112 per cent increase and an average price tag of £228,518.

Other notable areas experiencing a surge in agreed sales include Caerphilly (+104%), Keynsham in Bristol (+97%) and Royton in Greater Manchester (+96%).

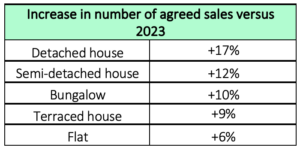

This year, the British property market has seen a 13 per cent increase in the number of sales agreed, signifying a marked recovery. The revival is predominantly led by detached houses, which have outpaced other types of property with a 17 per cent increase in sales agreed, which is in stark contrast to the modest 6 per cent increase for flats.

Experts attribute this revival to a number of factors including an increase in supply, pent-up demand from the previous year and more favourable mortgage rates compared to the peak observed in July of last year. This combination of factors is especially beneficial for the sales of larger homes, hinting at a robust year ahead for the property market, particularly for those looking to buy or sell detached houses.

Rightmove’s property expert Tim Bannister, commented: “For a long period during the pandemic and into last year, there was very little availability of larger homes. With not much choice of property to move to, this deterred some larger-home sellers from coming to market. Last year, movers had to adjust from historic low mortgage rates to much higher levels. Whilst some larger-home sellers may have built up more equity over time, others looking to take out a larger mortgage on a more expensive home would have been particularly impacted. Now, rates have come down from their peak, whilst prices have remained stable, and we have a group of larger home sellers who are seizing the opportunity to come to market. The increased choice is being met with more demand, resulting in higher numbers of sales.”

Ben Gee, Founder of Hat and Home in Berkshire, added: “The first 10 weeks of 2024 has seen a noticeable shift in demand with 25 per cent more applicants registering to buy compared to the same period last year. What’s particularly interesting is that registrations for properties over £700,000 have increased by 41 per cent.”