Property Investment

How Much Can You Save Buying Property at Auction?

New research has revealed how much money UK property investors could save by purchasing a property at auction, as well as identifying the possible pitfalls of this increasingly popular method of purchase.

Saving Money at Auction

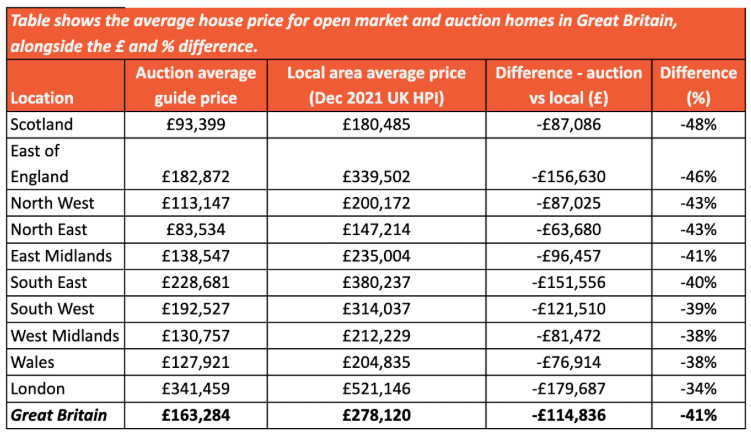

The most common reason for property buyers to attend an auction is to save money. The research found that, on average, properties purchased at auction in the United Kingdom sell for 41 per cent less than those on the open market. With the national average house price sitting at £278,120, this equates to a saving of about £115,000.

Furthermore, the amount saved buying at auctions versus the open market varies by area. For example, in Scotland savings can be as high as 48 per cent, which equates to a price difference of approximately £87,000 while London auction sales achieve the most savings in terms of monetary value realising savings of up to £179,000 (a 34 per cent difference). If property investors buy at auction in the East of England, they can typically expect to achieve the next highest savings in terms of price paid by saving £156K when buying at auction, while in the South East savings are typically £151,000. So, there are some big savings to be made!

Speed and Certainty of Purchase

After price, one of the key advantages of buying a home at auction is speed. Unlike buying a property on the open market, sales are not affected by common delays like chains. When the hammer falls on an auction property, the buyer receives the keys a short time afterwards. According to the researchers, on average, the whole auction process takes around a month, compared to six months on the open market.

Another benefit of bidding at auction is that purchases are guaranteed; neither the seller nor the buyer can back out at the last minute because the hammer’s fall is a legally binding moment. This adds a layer of assurance to the process, allowing all participants to execute their tasks without fear of the sale falling through.

Bidding Transparency and Purchase Confirmation

Another advantage of property auctions is the overall transparency of the bidding process. As a bidder, you will be fully aware of the price as it climbs and have complete power over whether to increase your bid or not.

Having a final fixed agreed auction price that is legally biding also prevents buyers from falling victim to gazumping, in which a bidder’s offer is approved only to have it revoked at the last minute because another buyer has stepped in with a larger offer, which is unfortunately still quite common with open market sales.

Things to Know When Buying at Auction

There are usually a good variety of properties available at auction, some in good condition, but many have issues that might deter buyers on the open market. For example, properties may have a short lease or aren’t built of traditional materials so buyers may not be able to fund their purchases using a mortgage, which is a common purchase method for the majority of buyers. This is often why auctions are more popular with professional buyers or cash buyers who don’t require a mortgage.

Another issue with auctions can be that due to the shorter buying timeframes, surveyors and solicitors have less time to complete their work, resulting in lower levels of due diligence. However, with auction properties, it really is essential you dot all of the I’s and cross all the T’s with regards to the legal and survey side of your purchase to ensure there are no unwelcome surprises after your purchase that could suck all of your profits from the deal.

Finally, property investors buying at auction should also be aware that the auction house will take roughly 2.5 per cent of the final sale price as a commission. Buyers will usually also be charged an administration fee, which will usually be listed in the catalogue or property information pages. Other fees or charges that may also apply can usually be found in the legal pack.

Still Interested in Buying at Auction?

Both professional property investors and amateurs regularly secure excellent bargains at auction. However due to the condition of many of the properties listed for sale at auction buyers who are able to renovate the property themselves will generally benefit the most, otherwise, the cost of renovations could quickly outweigh the auction savings.

James Forrester, Managing Director of Barrows and Forrester, an independent estate agent from Birmingham that conducted the research, commented:

“Buying at auction is more popular now than ever before. It’s fair to say that the rise of online auctions is responsible for this, not least because it helps everyday buyers avoid the intimidating environment of the traditional auction room, surrounded by competitors who are bidding every day.

However, it’s important to note that just like the open market, the financial agreements you’re making at auction are very real and deal with very large sums of money. It’s vital to be prepared, have your finances in place, do your homework on the properties you’re planning to bid on, and ensure all of the important surveys and checks are completed before the hammer falls.”