Property InvestmentProperty News

Discover the Top Regions for Rental Growth

Huge demand has seen regional rent prices grow by a whopping 8.5 per cent in certain areas of the UK while other areas have experienced a significant drop. Let’s find out the winning and losing regions in this month’s HomeLet Rental Index.

The Regional Rental Price Winners

Average rents in the UK have risen to record levels of just shy of £1,000 per calendar month (pcm) to £997pcm. This is up by 4.0 per cent compared to the same time last year.

According to data from the monthly index, every region bar London saw a rise in rent prices year-on-year (YOY) between May 2020 and May 2021, with average rents across the UK rising to £854pcm up 6.4 per cent when excluding London.

11 out of the 12 regions monitored by HomeLet showed a year-on-year increase in rental values, with both the East of England and the South West showing gains of over 8 per cent (East of England +8.5% and the South West +8.4%).

London – Annual Fall but Monthly Figures Tell a Different Story

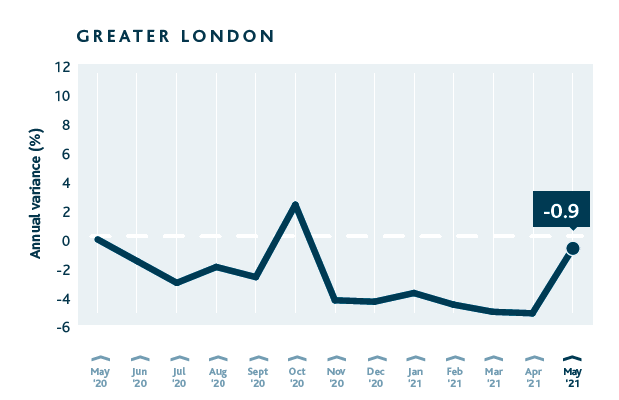

Rents in London continued to drop year-on-year to £1,583, down by 0.9 per cent on last year, the 12th decrease in annual variance in subsequent months.

However, when looking at London prices on a month by month basis, rental prices are actually rising in an upwardly direction with prices rising +0.2 per cent up on the previous month (April). If this trend continues, London may see positive year-on-year growth in the coming months.

The headline London year-on-year figures are also hiding the current upward trend with annual average rental prices in Westminster down 15.1 per cent; Hammersmith, Fulham, Kensington and Chelsea (down 12.5%), Camden (-11.9%) and Wandsworth (-10.7%) dragging the rest of London down. However, when you look at the monthly variations, these year-on-year losers appear to be recovering with Westminster +0.6 per cent on last month, Hammersmith and Fulham, Kensington and Chelsea (+2%), Camden (+1.1%) and Wandsworth (+1.1%).

HomeLet Comment

Data for the HomeLet index is gathered from HomeLet’s tenant referencing service, where the rental figures are based on rents achieved in that reported month. Commenting on the latest data, Andy Halstead, HomeLet & Let Alliance Chief Executive Officer, said: “Rental properties continue to play a crucial role in meeting the demands of people up and down the country, and the flexibility and responsiveness shown by the private rental sector will be vital in the coming months as the country opens up again.

“The overwhelming success of the vaccination drive brings hope that returning to some form of normality could be on the horizon. However, we would still caution that millions could be made unemployed at the end of the furlough scheme – posing considerable problems in tandem with an unbalanced rental market. Whilst the Government looks to stimulate homeownership, the importance of the private rented sector can’t be understated and should not be overlooked.”

Rental Yields Largely Unaffected by Extremes of Demand

Although rental price growth has been erratic, it appears rental yields have been widely unaffected by the peaks and troughs of the Brexit negotiations and the subsequent pandemic lockdowns.

The latest research by nationwide Build-to-Let specialist, Sequre Property Investment, reports that the rental sector continues to prove a lucrative one for those investing in the right areas. Its research analysed the average rental yield across 21 major cities in England and Wales over the last five years and found that across the nation, rental yields have averaged 5.1 per cent per year since 2015.

The best performing city was Manchester, with rental yields averaging 5.5 per cent a year. Sunderland also performed well with average rental yields of 5.4 per year, while Nottingham (5.3%) and Newcastle (5.2%) have also registered a strong performance.

Bottom of the rental yield table was Cambridge, which has seen the lowest average rental yield since 2015 at just 3.2 per cent. Bournemouth was the only other city to also slip below the 4 per cent mark.

With changes to buy-to-let tax relief, an increase in the rate of stamp duty on buy-to-let and second homes, and more recently, talk of changes to capital gains tax, the build-to-let specialist says property investors could be forgiven for thinking the Government wants to deter investment in the rental sector. However, Sales Director at Sequre Property Investment, Daniel Jackson, explains why investors shouldn’t be put off: “The increasing cost of property coupled with current uncertainty within the rental market can make investing in the rental market a daunting business. However, it remains a lucrative venture for those who know where to invest and what to invest in.

“The key is to know your market and to appreciate that property investment should be undertaken with a long term view, rather than a smash and grab mentality,” he added.