Property InvestmentProperty News

Which Region Has the Biggest Property Bargains?

Being a seller’s market at the moment, with house prices at record levels and buyers competing with each other to secure a purchase due to there not being enough properties on the market to satisfy demand, buyers may be struggling to find a good deal in these market conditions. However, it seems there are some areas around Britain where despite the strong market conditions, houses aren’t going for the full asking price (or even higher). In today’s article, Propertista looks at new research that reveals where buyers can cash in on the biggest asking price reductions in an otherwise red hot housing market.

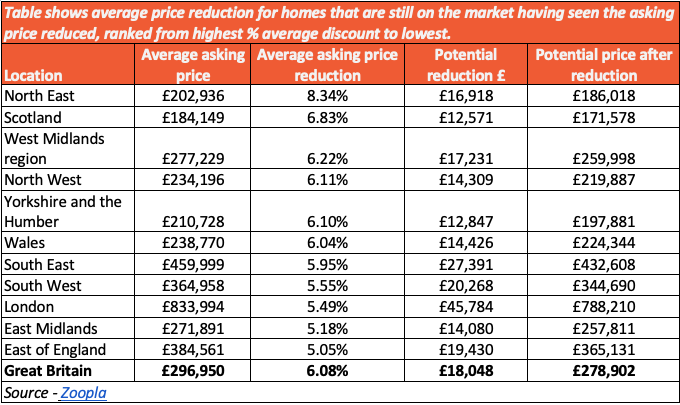

According to the research, the British region where the average price reduction is the highest is the North East where, on average, asking prices are being reduced by 8.3 per cent. With an average regional house price of £202,936 in the North East, this reduction marks a potential saving of £17,000 per purchase.

Scotland is the region with the next highest price reductions, which are averaging 6.8 per cent. With an average price of £184,149, the potential saving for buyers in Scotland is £12,600.

The West Midlands is the region with the next highest price reductions where asking price reductions are averaging 6.2% offering buyers savings of around £17,200; this is followed by the North West (6.1%) offering savings of £14,300; then Yorkshire & Humber (6.1%) offering potential savings of £12,800 and Wales with reductions of 6 per cent, which equates to savings of around £14,400.

Elsewhere, the South East with average price reductions of 6% offers savings of £27,400 while the South West (5.6%) offers savings of around £20,300.

Despite having the third-lowest percentage drop in Britain at just under 5.5 per cent, London’s high house prices mean buyers can expect to save £45,800 on original asking prices, while the East Midlands (5.2%) and the East (5%) offer savings of £14,000 and £19,400 respectively.

Across Britain, those properties currently on the market to have seen a drop in asking price expectations are 6% more affordable than when they first entered the market – an £18,000 reduction for homebuyers looking to snap up a bargain.

The research from Barrows and Forrester analysed current property listings for homes that have seen an asking price reduction to highlight which regions currently offer the biggest discount.

James Forrester, Managing Director of the Birmingham estate and lettings agent, Barrows and Forrester, commented: “Despite record high house prices and consistent levels of buyer demand, it is possible to find properties that have lowered their asking price expectations in the current market.

The reasons for this differ from home to home, but it might be down to impatient sellers wanting to move quickly, a structural problem coming to light after the home was already on the market, or a simple case of being situated in one of those rare pockets of low demand.

While it’s advisable to move quickly in current market conditions, it always pays to do your research and see how long a property has been listed for, as well as enquiring as to the level of attention it has received. By doing so you can identify if an asking price reduction is imminent or if you can simply secure one during the negotiation process without having to wait.”