Property InvestmentProperty News

UK Rental Market Rebounds Following 57% Coronavirus Decline

Demand for rental properties in the UK has rebounded in April following a significant decline in demand in the weeks leading up to the Coronavirus lockdown, a new market report has revealed.

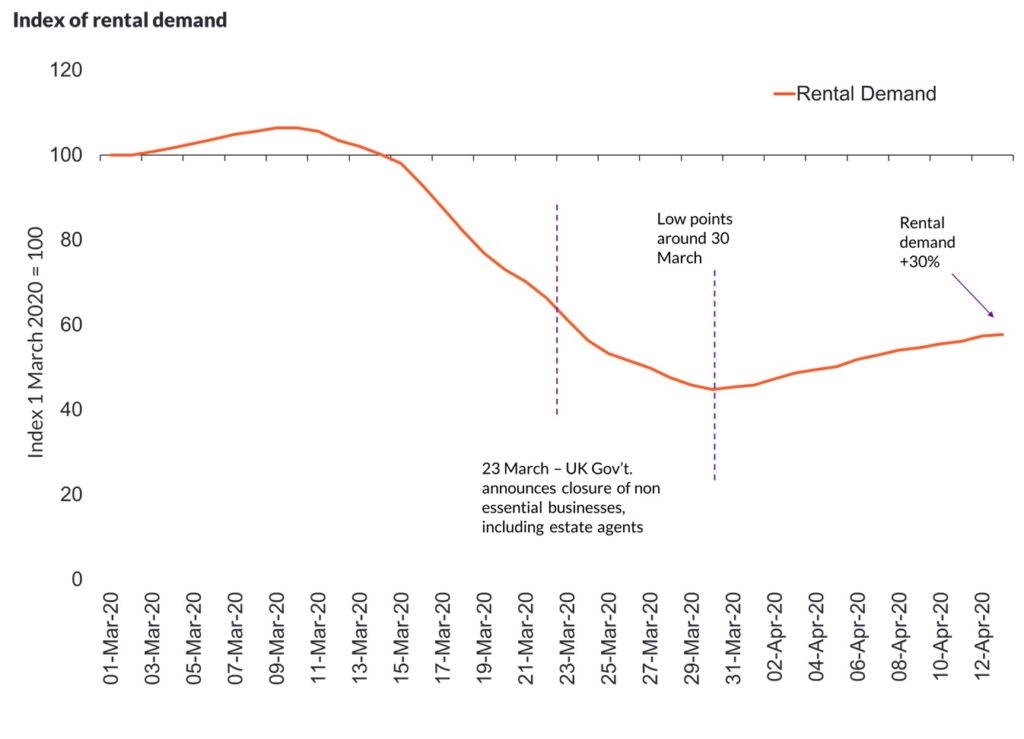

The UK rental market suffered a huge 57 per cent decline in demand for rental housing in the two weeks to 30 March 2020, driven by the impact of coronavirus, the report shows. However, the sector has regained some, but not all, of its lost momentum in the two weeks to 14 April 2020, with demand for rented homes rising 30 per cent.

Figure 1: Weekly change in demand (Indexed 100 = 1st March)

Despite these renewed signs of life, rental demand was still 42 per cent lower in mid-April compared to demand at the start of March (Figure 1), according to Zoopla’s latest quarterly Rental Market Report. Furthermore, rental supply, which had increased ahead of the lockdown as landlords switched from the short to long-term let market, has now slowed.

The most popular rental price brackets

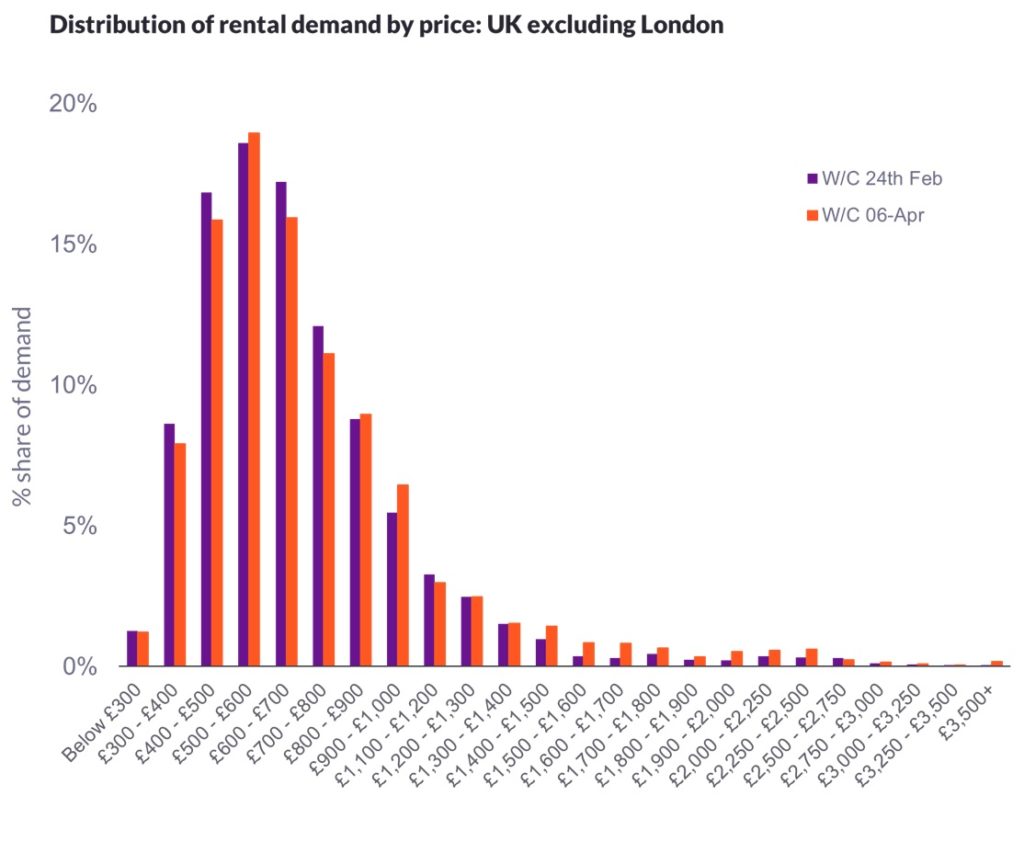

The rental market report shows growth in demand was uniform across the market both by region and price bands with the £500-£600pcm bracket being the most popular with prospective tenants browsing the property portals across the country (excluding London). This activity was consistent with trends seen before COVID-19 emerged, the portal observed.

By contrast, London recorded a marginal shift in demand, with the largest proportion of interest focused on properties with rents of between £1,200 – £1,300 pcm in April, compared to February, when the greatest interest was in properties priced between £1,400 – £1,500 pcm. This shift may be due to a change in the financial circumstances of the tenants searching the portal following the Coronavirus lockdown.

UK Rental market resilience

On a positive note for landlords, Zoopla says the impact of Coronavirus has been less pronounced in the lettings market compared to the sales market. The online property portal saw demand for rental properties fall by more than 55 per cent between 7th and 30th March (before it rebounded), while, in contrast, the sales market was hit by a 70 per cent decline in buyer demand after the government effectively suspended transactions with the implementation of its emergency Covid-19 pandemic measures.

Furthermore, Zoopla believes the increased market uncertainty means households looking for a home will likely turn to the rental market first to meet any immediate housing needs. Rental demand will also be driven by the additional flexibility in the lettings market, which allows agents to agree rental contracts with delayed start dates and agree terms based on online viewings, meaning that activity has been able to continue throughout the lockdown, albeit at a significantly lower rate.

Similarly, the portal predicts that the rental market activity levels will rise more quickly than the sales market once the coronavirus lockdown eases, given that the average ‘time to let’ is less than three weeks in usual market conditions compared to the average of three months it takes to complete a sale.

The underlying strength in rents

Despite the slight slowdown in growth, rental growth has been on a largely upward trajectory since March 2017 amid increased demand and shrinking supply.

At city level, the spread of rental growth ranges from 5.9 per cent in Nottingham to -2.1 per cent in Aberdeen. In London, annual rental growth in London has fallen to 1.7 per cent, which is down from 2.3 per cent in the previous quarter, but this figure is broadly in line with the same period in 2019 (1.8%). This slight decline may also partially reflect a slight easing in demand given the post-election bounce in the sales market.

Market predictions

Zoopla has also provided some predictions in its recent market report. There are usually around 1.2 million moves a year in the lettings market however the property portal expects this figure to fall 25 per cent in 2020 due to the impact of the pandemic on Q1 and Q2 transactions.

The portal also predicts that while annual UK rental growth is up 0.9 per to at 2.4 per cent from March last year, it expects growth for the rest of the year will be moderate and remain in positive territory – a fairly positive outlook considering the state of the market as it is now under lockdown.

“As with the whole housing market, activity levels and rental growth will likely be closely aligned to the economic landscape of the UK once the lockdown eases and the immediate impact of COVID-19 starts to recede,” Gráinne Gilmore, Head of Research, Zoopla explained.

Commenting on the April rental market rebound, Gilmore added: “The rise in demand in the first two weeks in April indicates that some tenants are already mapping out their next move. The flexibility of the rental market is one of the key factors which has allowed activity to bounce back more quickly than other parts of the property market.”