Property InvestmentProperty News

UK Property Market Surges to Catch-Up After 27bn Lockdown Loss

UK property sales have boomed significantly to 28 per cent higher than pre-lockdown levels after experiencing record levels of demand when the markets re-opened. However, despite this strong performance, new research is predicting that house sales across the whole of 2020 will be 15 per cent lower than in 2019. This is because, although pent-up demand is driving house sales at a phenomenal rate currently, overall sales volumes have been stifled by the recent Coronavirus pandemic market closures.

House Market Loses 124,000 Sales

The UK property market is effectively playing ‘catch-up’ after suffering the loss of around 124,000 sales, worth around £27bn, since March.

This month’s Zoopla House Price Index report powered by Hometrack found that after the strongest start to the year for five years, completed sales between the start of January and the end of June are lagging 20 per cent behind 2019’s figures This equates to some 124,000 lost sales.

Despite this huge setback, Zoopla’s researchers predict by the end of the year, the market will recover somewhat, with total transaction volumes expected to net out at 15 per cent below 2019 levels.

A Supply and Demand Imbalance

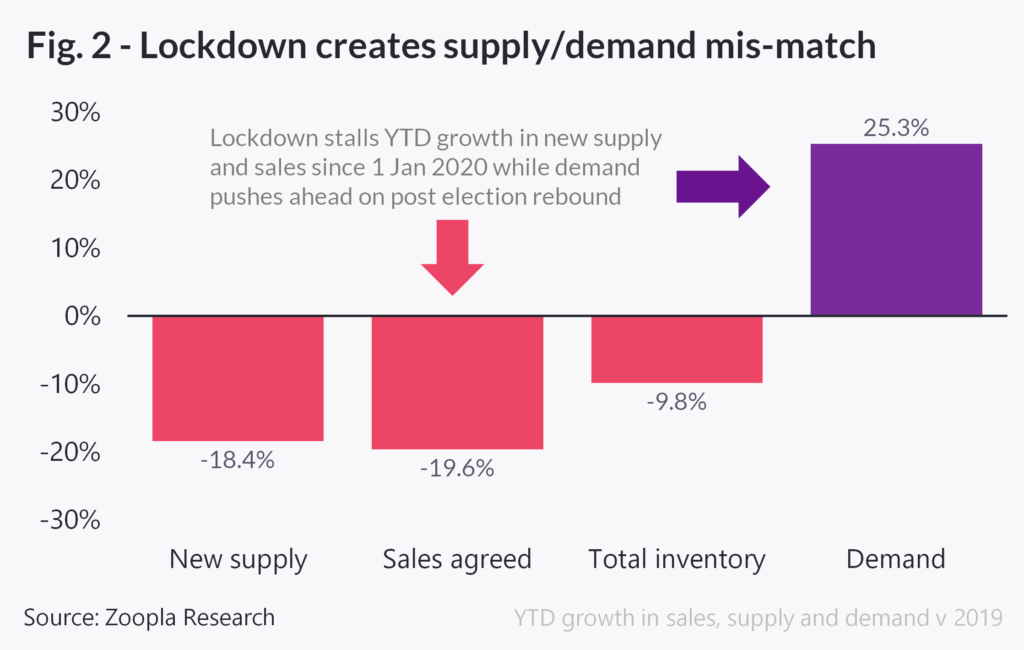

The dynamics of housing supply and demand have been heavily impacted by the lockdown, which effectively stalled the property market for 50 days in England, with the market suspension reducing the flow of new supply and sales agreed by 90 per cent. While transactions are now rising ahead of their pre-COVID levels, Zoopla’s research found both sales and housing supply are still lagging 20 per cent behind 2019’s figures with stock levels running at 10 per cent below this time last year [figure 2].

By contrast, demand for housing has rebounded strongly as pent-up demand returns to the market. In fact, in the last month alone, demand from buyers was double that of the same period in 2019.

Zoopla’s researchers believe this demand is primarily made up of buyers catching-up for lost time over lockdown, estimating that returning buyers account for 80 per cent of the current record-breaking levels.

Looking at trends since the start of the year, the research makes clear there is a widening gap between supply and demand. This is expected to bolster house prices over the second half of 2020 with year-on-year declines in capital values unlikely before the year-end.

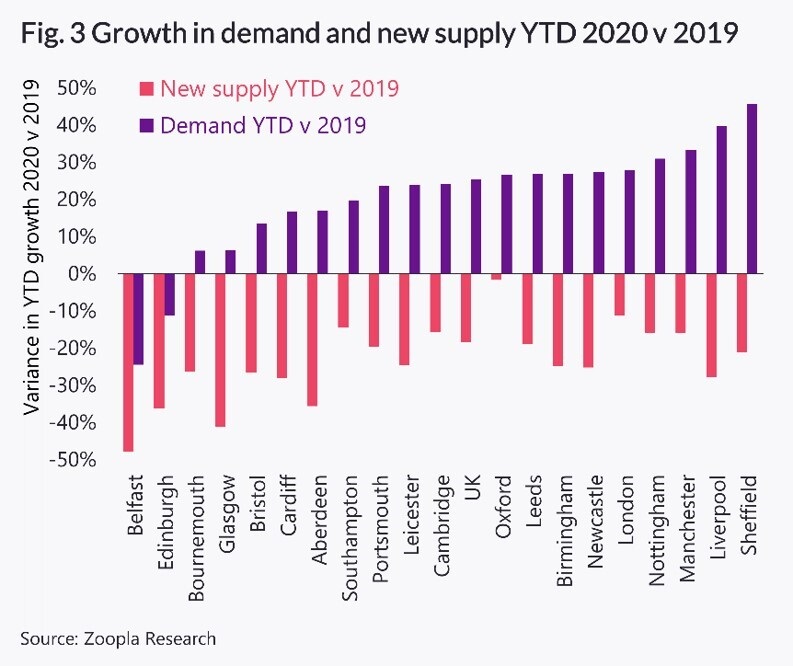

Regional cities across the north of England have bounced back strongly recording higher growth in demand in the first half of 2020 compared to 2019. However countrywide, new supply hasn’t bounced back to 2019 levels leading to a shortage of supply [figure 3] meaning house prices are holding their own, and even creeping up a fraction in some regions.

The greatest short-term support for prices will be in cities where demand has grown the most over the first seven months of 2020 compared to 2019 – top of the list for demand are Sheffield, Liverpool, Manchester and Nottingham, which are all the top fastest-growing cities [figure 3] in terms of house price growth this year to date (YTD).

The Exodus from Cities is Only Temporary

The research found that short-term demand for city living appears to be holding firm. There had been a lot of speculation about the long-term demand for city homes with research suggesting COVID had majorly boosted demand for homes in the suburbs. However, Zoopla expects this to be a one-time reaction to the UK’s draconian lockdown measures rather than a long-term ‘seismic shift’ in consumer attitudes.

In fact, London ranks fifth for growth in demand thus far in 2020 [figure 3] with demand only seeing a modest shift away from the city centre towards the suburbs and commuter belt as the priorities of today’s buyers, who want a garden and are planning to commute less, changed in response to the lockdown restrictions.

Zoopla sees this as “a shift in consumer focus rather than a structural change in market fundamentals” however.

Stamp Duty Regional Bias

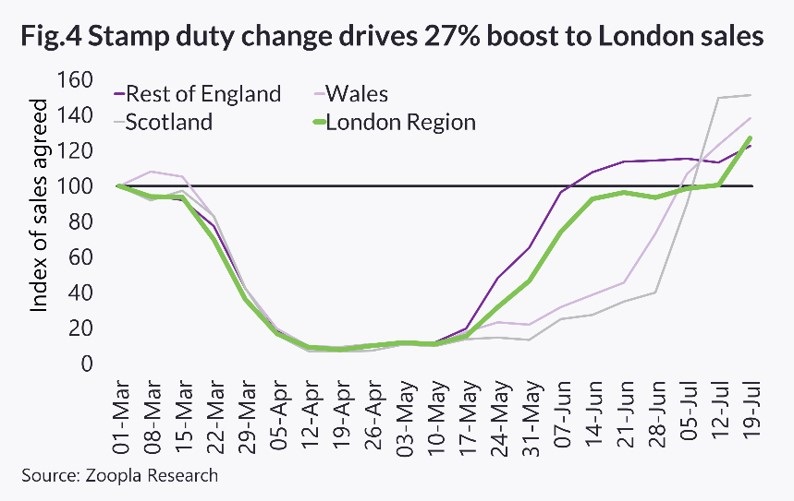

Despite an overall decline in annual transactions, London enjoyed an immediate boost to sales agreed following the implementation of the stamp duty (SDLT) cut that runs until March 31 2021.

New sales agreed increased by over a quarter (27%) in London in just two weeks after the new SDLT thresholds were announced on 8 July. London is set to benefit more from the recent SDLT changes than other regions due to the proportionately larger number of properties costing more than the £500,000 stamp duty threshold [figure 4].

In regions where average property prices are lower and less responsive to stamp duty amendments, a boost in transaction volumes has not been replicated [figure 4].

While the new rates of SDLT will support demand in higher-value markets in the short term, demand is not expected to continue to grow in 2021 beyond the discount’s cut-off date at the end of March next year.

Outlook

At present, UK house price inflation in the 12 months to June 2020 has edged up to +2.7 per cent, registering the highest level of annual growth for almost two years. By contrast, the monthly rate of growth has halved to 0.2 per cent and Zoopla’s city-level price indices are still registering slower growth as a result of the lockdown.

On a positive note, while there is a wide variation in annual growth rates across the country, there is no evidence of material, localised annual price falls at a regional or city level.

Based on current trends, Zoopla researchers expect the headline annual rate of growth to remain positive as the growing imbalance of supply and demand supports prices for the remainder of the year.