Property InvestmentProperty News

The State of the UK Property Market After COVID-19

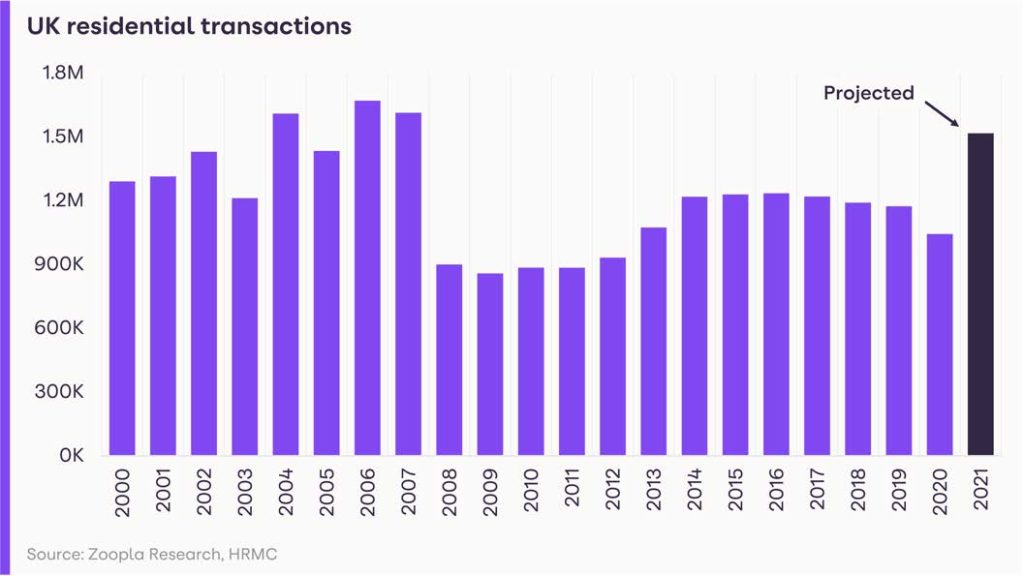

The UK property market is continuing to rally following the pandemic lockdowns and is being driven by strong demand from homebuyers, new data has revealed. Sales completions are forecast to reach 1.5 million this year, up from 1.04 million last year – the highest level since 2007. The value of sales in 2021 is forecast to be £461 billion, up an impressive 68 per cent from 2019. Furthermore, although fractionally down on the 4.7 per cent peak earlier in the year, annual house price growth is also up on last year at 4.1 per cent, which is almost double the 2.3 per cent increase in April 2020.

These price rises are due to demand from buyers continuing to outstrip supply. Indeed, the total stock of homes for sale was down 20.8 per cent in the year to mid-May compared to the average last year.

Buyer demand has been strong since the end of the first lockdown last year as households reassess how and where they are living. For some, the need for more space, especially if they are working from home, has prompted a move. This is evidenced by the fact that across the UK, the demand for family houses continues with its upward trend, with average values for houses up +5.2 per cent on the year, compared to +1.1 per cent growth for flats.

People are also craving life on the coast after being locked indoors for months on end, while first-time buyers are also becoming more active in the market, with more attractive mortgage finance flooding the market, including the new mortgage guarantee scheme announced in the latest Budget that enables UK homebuyers to secure a mortgage up to £600,000 with a 5 per cent deposit.

The stamp duty holiday, and its subsequent extension to June and tapered extension to the end of September, has also provided an added additional impetus for many to purchase a home.

Zoopla analysts predict that activity will remain elevated in the second half of the year, albeit not as high as towards the end of last year.

House Price Growth Linked to Affordability

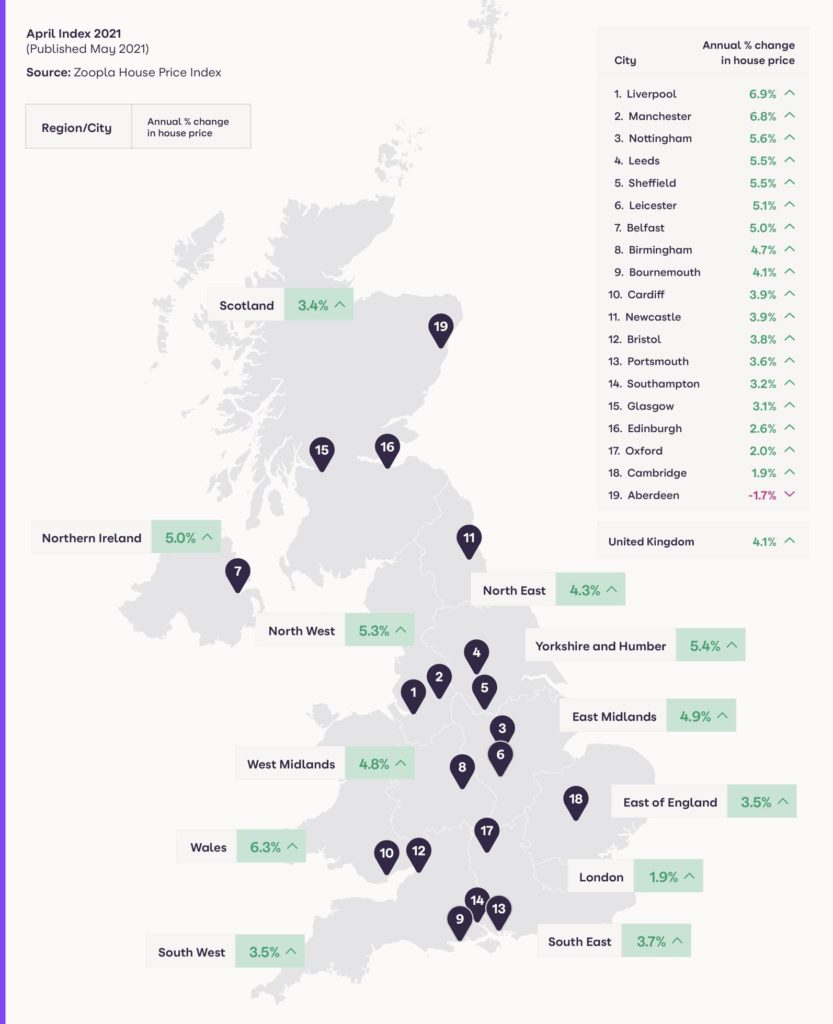

However not all areas are experiencing high price rises… Zoopla’s House Price Index reports that growth is highest in areas where affordability is greatest. For example, in the year to April, average prices in Wales rose by 6.3 per cent, followed by Yorkshire & the Humber where prices rose by 5.4 per cent while in London house price growth was sluggish at 1.9 per cent, the slowest regional rate of growth across the UK for the sixth consecutive month. In fact, four central London boroughs registered price falls for the third or fourth consecutive month, including the City of London (down -2.5% year on year), Westminster (-2.2%), Kensington & Chelsea (-1.7%) and Hammersmith & Fulham (-1.4%). Zoopla analysts attribute these falls to the fact that London has suffered under the lockdowns with the lack of international visitors and affordability constraints.

How City Property Markets are performing Post-Covid

On a city level, Liverpool and Manchester with average house price rises of +6.9 per cent and +6.8 respectively are registering the highest price growth of major cities monitored in Zoopla’s report… the fifth consecutive month this has been the case.

While the ‘hottest’ city markets, where homes are being sold more quickly and price growth is amongst the strongest include Wigan, Blackburn and Burnley where time to sell is down by three weeks or more, and annual price growth is at least 5.8 per cent.

Market Outlook

Grainne Gilmore, Head of Research, at Zoopla says their data suggest that the easing of lockdowns will continue to cause a natural fall in demand as people are able to see family and enjoy amenities that have been shut for more than a year, but they expect: “new buyer demand will still emerge throughout H2 as office-based workplaces confirm if they will be pursuing more flexible working practices. Households who have the opportunity to commute less frequently have more options when it comes to choosing where to live, and this could prompt a move.

Likewise, older households will continue to review how and where they are living, with many more set to move for the first time in years. With an increased array of mortgages to choose from, first-time buyers will also remain active in the market.

At the same time, supply constraints will continue to underpin pricing. The lack of supply is expected to hamper potential sales during this year, yet even so, we expect total transactions this year to rise to 1.5 million, marking one of the busiest years in the UK’s residential market in more than a decade.”