Property InvestmentUncategorized

The State of the UK Housing Market After COVID and Brexit

Both Brexit and the subsequent Covid-19 pandemic have had a huge impact on the UK’s property market over the past five years. Can you believe it has been over five years since the Brexit vote in June 2016? It’s been an incredibly long period of sustained challenges for the industry, however, as has been the case historically, the property market is very resilient, and the latest data from the Office for National Statistics (ONS) demonstrates just how resilient it has been.

UK Property Prices Increase Year-on-Year

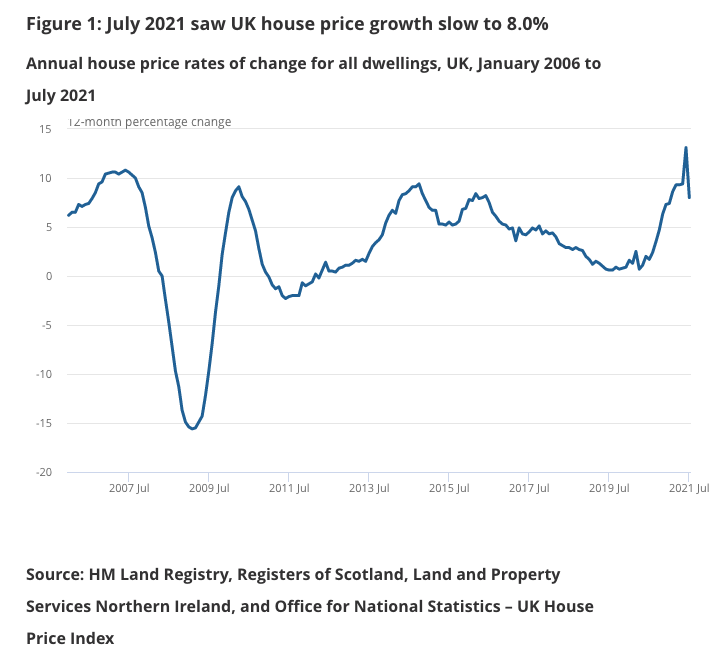

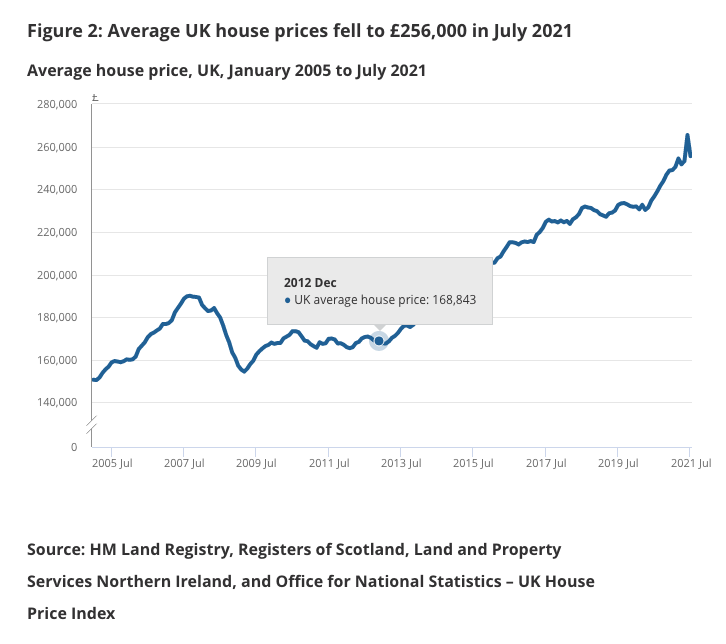

The latest house price data published by HM Land Registry for July 2021 show that not only have average house prices in the UK increased by 8 per cent in the year to July 2021 but that the average UK house price rose by £19,000 year-on-year (from c.£235,000 to £256,000 to July 2021).

On a non-seasonally adjusted basis, average house prices in the UK decreased by 3.7 per cent between June and July 2021, compared with an increase of 0.8 per cent in the same period a year ago.

On a seasonally adjusted basis, average house prices in the UK decreased by 4.4 per cent between June and July 2021, following an increase of 4.5 per cent in the previous month.

Although these figures are down on the previous month’s statistics this drop was to be expected as the market slowed down following a rush to complete sales before the June Stamp Duty holiday deadline, the shortage of property stock and the usual summer market slow down.

Nick Leeming, Chairman at Jackson-Stops explains the tailing off: “July saw the market begin to settle further as buyers and homeowners reacted to the winding up of the SDLT holiday, and took the opportunity to rest, socialise and take stock over the summer months after a challenging year. The pace of activity over the last year has depleted stock levels and for some time this fuelled price growth due to the significant imbalance between supply and demand.

“However, while we may see a brief slowdown, this won’t last for long. Our data continues to show there are on average 25 buyers for each property on our books.”

Commenting on the slight decline from June to July, Founder and CEO of GetAgent.co.uk, Colby Short, added: “Before we run for the hills at the first sight of a house price decline it’s important to note that the market has been moving at a record pace for a sustained period of time and so a pause for breath is more than natural.

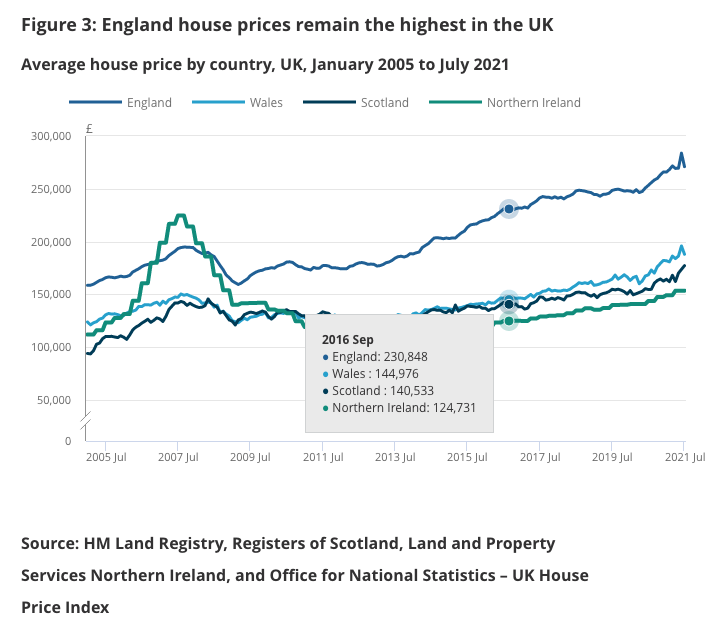

House Prices By Country

Data for the UK’s four nations also show significant year-on-year gains with average house prices increasing 7 per cent in England to £271,000, in Wales rising 11.6 per cent to £188,000, in Scotland up 14.6 per cent to £177,000 and in Northern Ireland rising 9 per cent to £153,000.

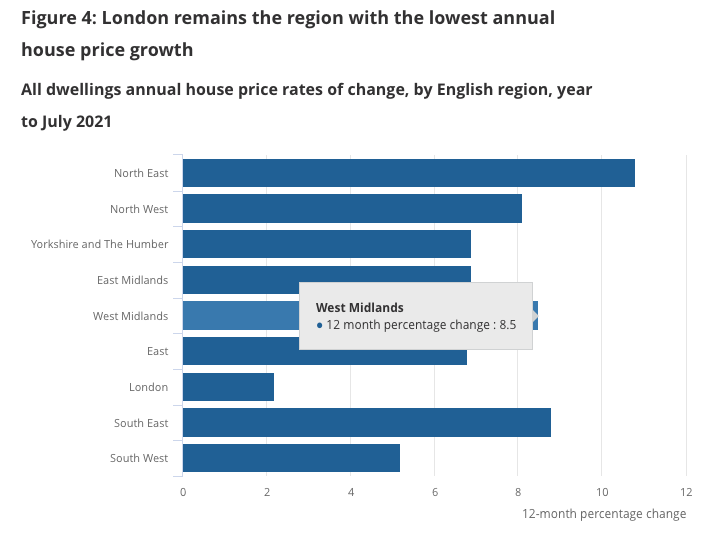

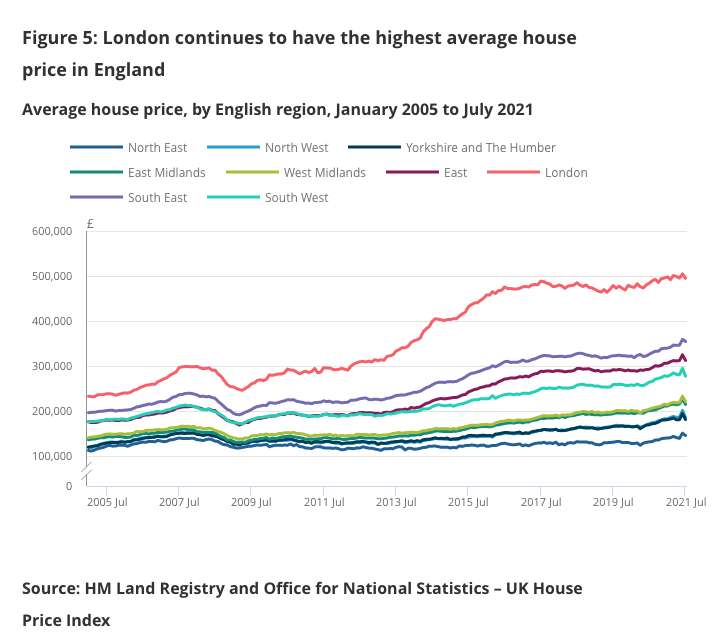

House prices By Region

The North East was the region with the highest annual house price growth, with average prices increasing by 10.8 per cent in the year to July 2021. However, this was down from 15.8 per cent in June 2021 (Figure 4).

Next up was the South East with prices increasing by 8.8 per cent in the year to July 2021, then the West Midlands (8.5%), the North West (8.1%) then Yorkshire and the Humber and East Midlands joint fifth at 6.9 per cent.

When comparing regional data, London continued to be the region with the lowest annual growth (2.2%) for the eighth consecutive month.

The North East continued to have the lowest average house price, at £145,000, having surpassed its pre-economic downturn peak of July 2007 in December 2020 (Figure 5).

While London’s average house prices remained the most expensive of any region in the UK, at an average of £495,000 in July 2021.

Director of Benham and Reeves, Marc von Grundherr, provided some insights on London’s predicted return to form: “We expect the return of foreign buyer demand to further boost the UK housing market over the coming months, with London, in particular, seeing a sharp increase in market activity and house price growth.”

GetAgent’s Colby Short concluded: “Market sentiment is still extremely high and while mortgage affordability remains at record lows, the housing market will continue to blossom well into autumn and beyond.”