Property Investment

Should You Invest in Buy-to-Let or Commercial Property?

Buy-to-Let or commercial property? Which market is best to invest in the current property climate? Propertista takes a look.

So you have worked hard for years to build a healthy nest egg or you have inherited a lump sum. You want to invest it wisely and you have decided to invest it in property. How do you decide which sector will give you a better return on your money, buy-to-let or commercial property?

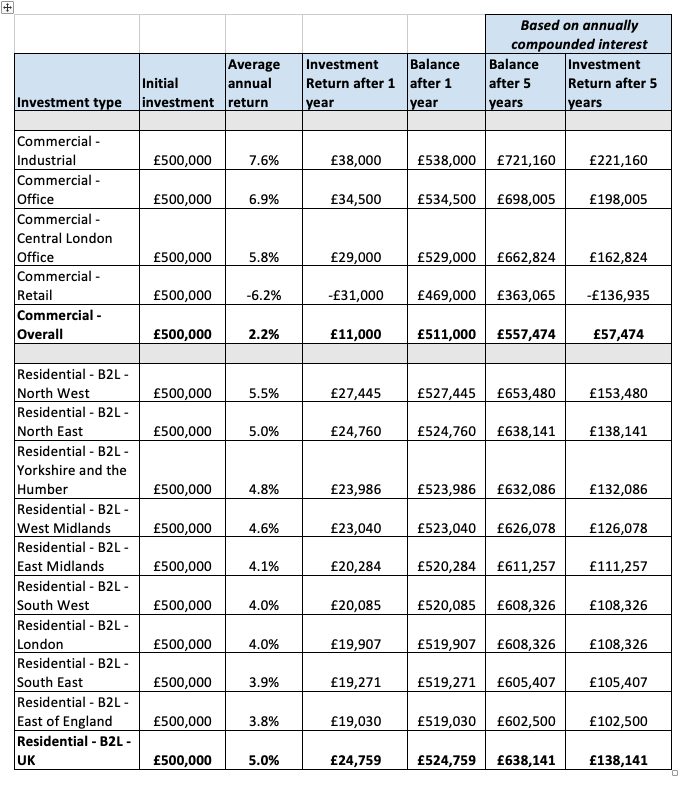

New research has explored which property sector is best to place a £500k investment across both the commercial and residential buy-to-let markets looking at the average annual return, to see which makes the most financial sense despite current market instability.

The research by the peer to peer lending platform Sourced Capital found that the residential buy-to-let market as a whole currently offers a better investment option than the commercial property market, with the average UK residential yield currently at 5 per cent, returning £138k over five years based on annually compounded interest.

These figures contrast with the current average return across the entire commercial sector of 2.2 per cent, meaning a £500k investment would return just under £60,000 over the course of five years – that’s around 43.5 per cent lower than a residential investment.

However, if you analyse the research further, you will see that initial the whole of market figures can be deceiving. In fact, the rental return can be more accurately calculated by looking at the location of your investment opportunity and narrowing down your potential return by the specific market sector you invest in.

When considering the location of your investment, the lending platform’s research found the best residential buy-to-let opportunities are currently the North West, where yields climb as high as 5.5 per cent on average, returning £153,480 over five years.

The North East and Yorkshire and the Humber are also some of the most profitable pockets for a residential buy-to-let, however, the East of England sits at the other end of the table, with an average yield of just 3.8 per cent, returning £102,500 over five years. The high cost of buying in the South East and London means they’re also amongst the worst regions for a residential buy-to-let return with five-year returns of 3.9 per cent (£105,407) and 4 per cent (£108,326) respectively.

Average house prices sourced from Gov.uk Average rent figures sourced from HomeLet Commercial property returns sourced from CBRE

Furthermore, rather than comparing the whole buy-to-let market to the commercial property market, where the average commercial yield registers as lower than that of the average residential market, if you look closer at the figures for investing in a commercial property, you will be able to see the returns for a £500k investment in a commercial property can actually be far higher than a residential property depending on which commercial sector you opt for.

For example, investing in an industrial commercial property secured a return of 7.6 per cent or £221,160 over five years – miles above the commercial market average of 2.2 of per cent and significantly higher than the top-performing residential sector yield of 5.5 per cent. Surprisingly in this post-lockdown period, office space was the next most profitable commercial sector with a 6.9 per cent annual return bringing a profit of £198,005 over five years. By narrowing your commercial property investment analysis to central London, the return drops marginally to 5.8 per cent per year. However, it is always good to be aware that investments can go up and down and it’s possible both the commercial office and London sectors may shrink in future as organisations look to downsize as they continue to see the benefits of their new work from home structures.

The only bricks and mortar investment in the list that would lose investors money currently is commercial retail space. Annually, this investment would lose you -6.2 per cent a year or £136,935 over five years. This figure is the one that drags the whole of the commercial sector returns down below residential yields, so it is definitely worth looking closer at the markets, breaking them down by location and sector to find your best investment opportunity.

Another option is choosing to have your investment managed. Sourced Capital suggests that investing via a peer to peer platform like theirs could see a return of 10 per cent a year*, climbing to as much as 12 per cent depending on the project you invest in. The platform calculates that over five years, this ‘hands-off approach’ could return a healthy £305,225, making it the most profitable as well as the least strenuous investment strategy.

Managing director of Sourced Capital, Stephen Moss, commented: “It can be hard to know where your money is best invested in times like these, but on the whole, residential bricks and mortar certainly makes for the most consistent option both in the long-term and regardless of geography.

Of course, commercial property carries a greater risk, but depending on which sector you opt for, these risks can be greatly rewarded.”

*Peer to peer lending rate sourced from Sourced Capital

**As with all investments, your capital is at risk and the return you receive on any investment can go up as well as down**