Property InvestmentProperty News

The UK’s Premium Property Markets Outside London

Research has revealed which areas of the property market are seeing the most prime purchases outside of London.

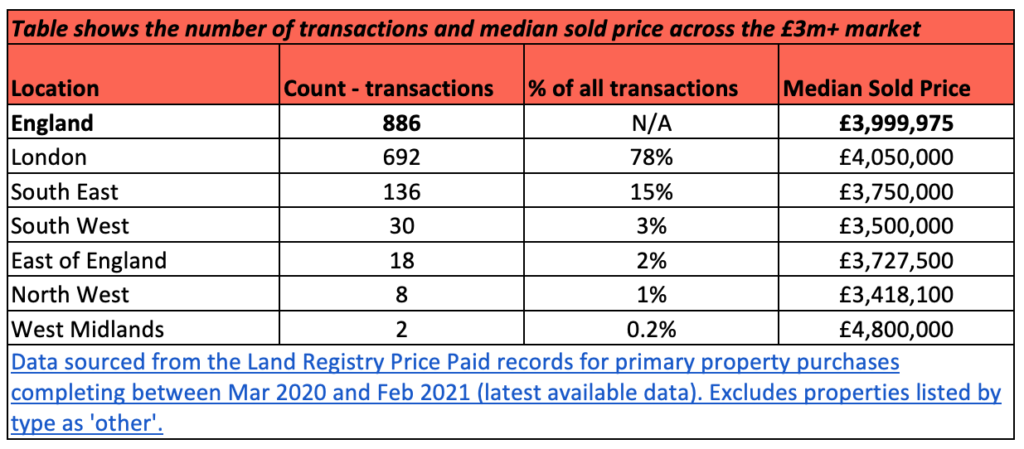

High-net-worth mortgage provider Enness Global Mortgages analysed property transactions of £3m and above across England over the last year and found that 886 homes were sold within the prime market with an average sold price just shy of £4m.

Unsurprisingly, London accounted for 78 per cent of these high-end transactions, however, the South East (15%), South West (3%), East of England (2%), North West (1%) and West Midlands (0.2%) also saw a number of homes sell for £3m and above.

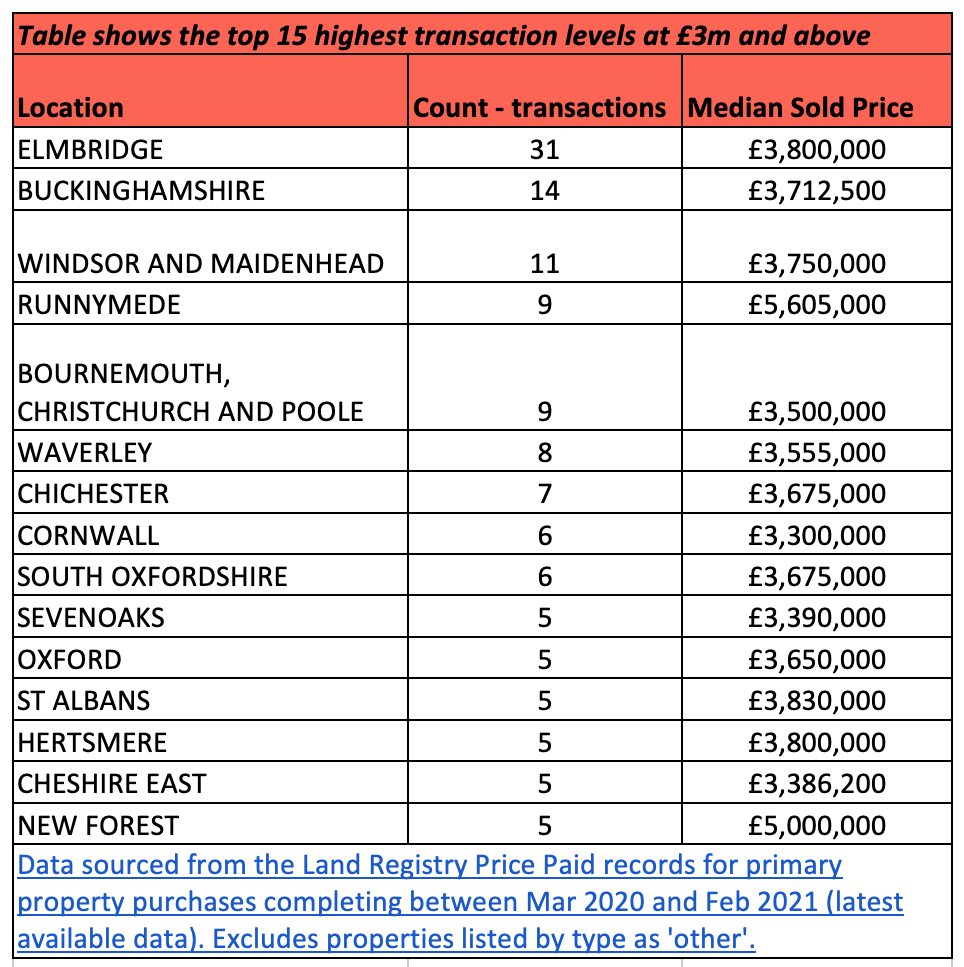

The Areas with the most £3m+ Prime Property Transactions

Outside of London, Elmbridge in Surrey, housing the popular towns of Esher, Cobham, Walton-on-Thames, Weybridge and Molesey, ranked as the nation’s prime property hotspot with 31 homes sold in the last year. Buckinghamshire also saw the number of high-end homes swapping hands amount to double figures (14), as did the royal borough of Windsor and Maidenhead, which registered 11 high-value transactions.

Runnymede, also in Surrey, and Bournemouth, Christchurch and Poole in Dorset also ranked high for high-value sales (9), followed by Waverley in Surrey (8), Chichester in West Sussex (7), Cornwall in the South West (6) and South Oxfordshire (6).

The remaining top 15 included Sevenoaks, Oxford, St Albans, Hertsmere, Cheshire East and the New Forest, all of which saw five homes sell at £3m or more in the last 12 months.

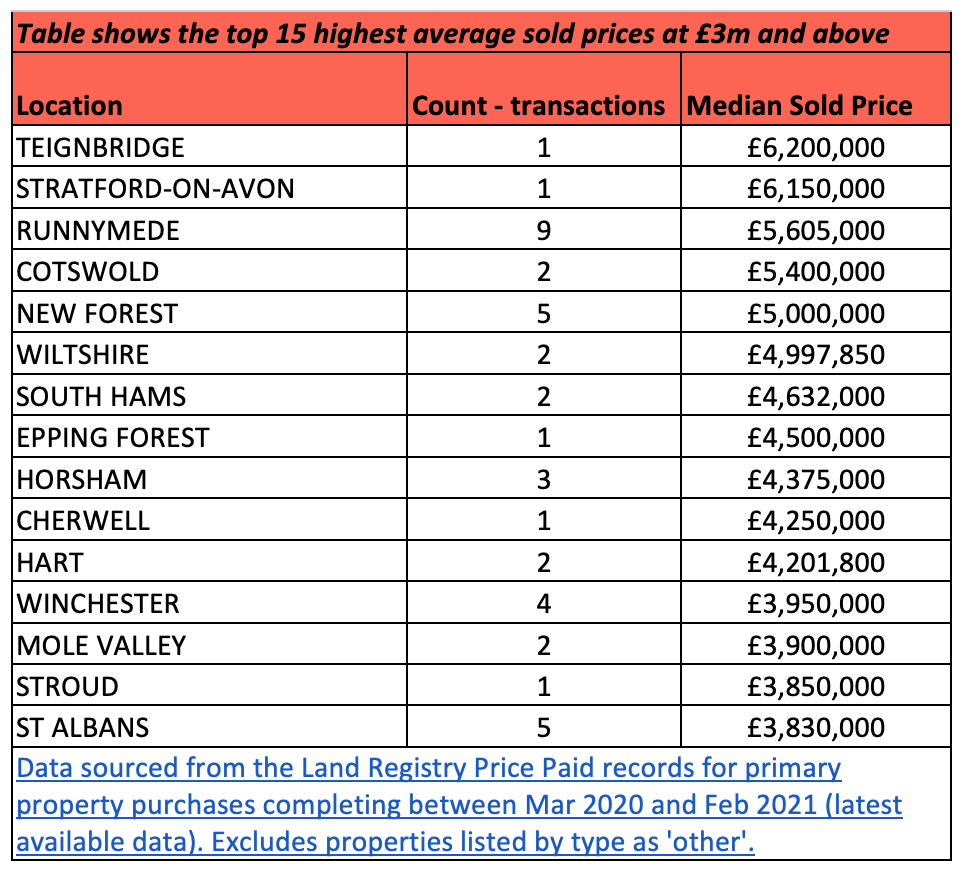

Highest average House prices

Teignbridge in Devon was home to the highest median sold price outside of London of £6.2m, with Stratford-on-Avon also breaking the £6m mark (£6.15m). Runnymede had the next highest median price of £5.6m, while the Cotswolds was £5.4m, the New Forest £5m with Wiltshire fractionally lower at £4.99m (see the table below to see all 15 areas boasting the highest median prices).

Islay Robinson CEO of Enness Global Mortgages commented: “With so much talk of the prime London market, you could be forgiven for forgetting that plenty of homes change hands for considerable sums outside of the capital.

“We’ve seen lockdown spur an uplift in buyer demand for bigger homes with more outdoor space and this is no different at the very top end, with high-end homebuyers also keen to upgrade the pandemic property potential.”

World Super Prime News

In other related news, Flora Harley, a senior analyst from Knight Frank, reported that worldwide super-prime sales only fell marginally in 2020 despite the property market shutdowns and travel restrictions brought on by the global pandemic, with the number of super-prime (US$10m+) transactions falling by just 1 per cent in 2020 compared to the year before. However, prices achieved were lower overall with the global average super-prime sale standing at $17.7m for 2020, 4 per cent below the 2019 average.

London was the largest super-prime market, with US$3.7 billion transacted across 201 sales. In fact, the UK’s capital saw transactions rise by 3 per cent, while Hong Kong and New York saw theirs fall by 27 per cent and 48 per cent respectively.

Domestic buyers accounted for a third of all activity in London’s £10m+ market, up from 12 per cent a year earlier; this reflects the difficulty international buyers have experienced accessing the UK’s markets over the past year.