Property InvestmentProperty News

Revealed: The UK’s New No.1 Property Hotspot

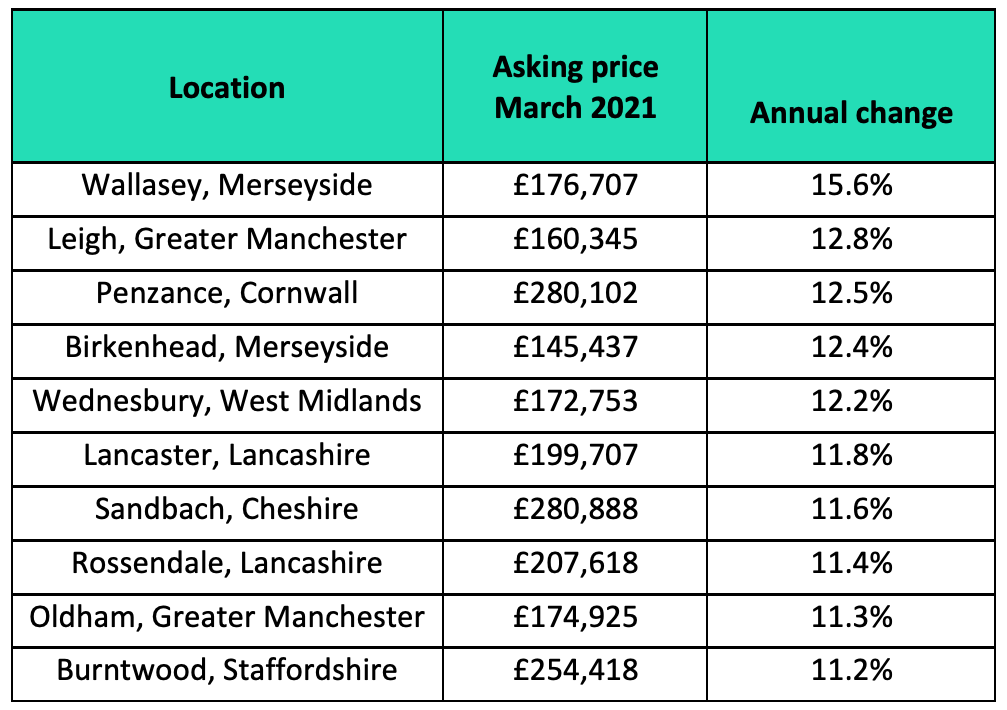

It has been reported in the national news this week that the property market in Cornwall is going crazy with 100s of applicants for each property, however, it is Wallasey in Merseyside that has scooped the crown for being the UK’s top property hotspot with asking prices up by 15.6 per cent annually.

New data from online property portal Rightmove has revealed that asking prices in Wallasey, which is located on the Wirral Peninsula on the mouth of the River Mersey, are almost £24,000 more expensive than a year ago with one in three properties in the town being sold within a week of being marketed on Rightmove throughout March and April.

In fact, demand in the area is so great that homeowners in the town are being approached by estate agents to see if they’d like to sell, a local newspaper has reported.

Second on the price hotspot list is Leigh in Greater Manchester where asking prices are up by 12.8 per cent.

Property price hotspots

Penzance, in Cornwall, takes the third spot, with prices up by over £30,000 (+12.5%). It is little surprise that Cornwall performed well on this list seeing as it recently replaced London as the most searched place on Rightmove, as more people look to move to the countryside or coast.

Wednesbury and Burntwood in the West Midlands make up the remainder of the top five areas boasting booming house prices, with asking prices rising 12.4 per cent and 12.2 per cent respectively.

However, it is the North West where the most asking price increases have been seen with seven out of the top ten highest asking price risers in the region.

Nationally, property demand is driving prices higher than ever before with asking prices at a record high of £327,797, an annual rise of 5.1 per cent. Furthermore, a quarter of all properties are selling within a week (23%) across the whole of Great Britain, which is the highest proportion ever recorded by Rightmove.

In April, Rightmove’s research also found that there were 45 per cent more buyers contacting agents about properties for sale than in April 2019.

This record buyer demand, coupled with the low amount of available stock per agent, has led to more agents prioritising physical viewings for buyers who are ready to proceed, with almost half of them (46%) asking that a buyer has already had an offer accepted on their home if they want to physically view a property, and just over a third (37%) asking that a buyer at least has their property already on the market. The reasoning behind this policy is clear… The number of people contacting agents to view a property who have already found a buyer for their existing home is almost double that seen during the first two months of last year before the pandemic (+89%), so they are ready to complete a property chain.

For first-time buyers, many agents are asking that they first have a mortgage in principle before they can start viewing properties.

All of this means those homeowners who want to try and find somewhere to move to before putting their home on the market will find it much harder to book in viewings in the current busy market.

Rightmove’s property expert Tim Bannister says: “The frenetic market opens up a very real possibility that you could miss out on the home you really want to move to if you haven’t already put your own up for sale, or if you’re a first-time buyer and you haven’t first researched what you can definitely afford. We recently found that a much higher proportion of chain free homes are up for sale, so it’s clear some buyers are already choosing to sell first and buy next rather than tie themselves into a chain. To put yourself in the best possible position before you request a viewing I’d recommend getting a mortgage in principle ready, and being clear on what the final asking price you can offer is if it is a hot market where the property is likely to go to best and final offers. Agents are telling me that because stock is so few and far between, they’re advising homeowners to first get an offer accepted on their own home, and they’re finding that many buyers are more willing to then give owners a bit more time to find their next place to move to before the chain can get moving.”

With demand this strong we expect to see asking prices continue to grow at least until the end of September when the stamp duty exemption period ends. In fact, there are signs these house price rises will continue into next year as the market continues to recover from five years of restraint brought on by Brexit and the subsequent Covid-19 pandemic.