Property InvestmentProperty News

Revealed: The UK’s Most and Least Affordable Property Locations

With the price of property so high at the moment, it can be very difficult to get a foot on the property ladder, especially if you are a first-time buyer. If you’ve got a limited budget, you may be asking yourself where you can afford to buy a property in your region. Well, now new research has been released that reveals the most affordable areas in each region. This information could be key to helping first-time buyers find themselves a new home in their desired region. Want to take a look?

Why are House Prices Rising?

First-time buyers and homebuyers with a low budget are in a tricky situation at the moment. The Government’s property market incentives such as the Stamp Duty Land Tax (SDLT) holiday and guaranteed mortgages requiring only 5 per cent deposits have not only provided a much-needed stimulus to the flagging UK property market, they have also created significant demand which has not been matched by enough supply. As such, house prices have risen at an unprecedented rate leaving first-time buyers struggling to compete with well-funded buyers, many of whom are relocating from city to country.

Where are House Prices Cheapest in Your Area?

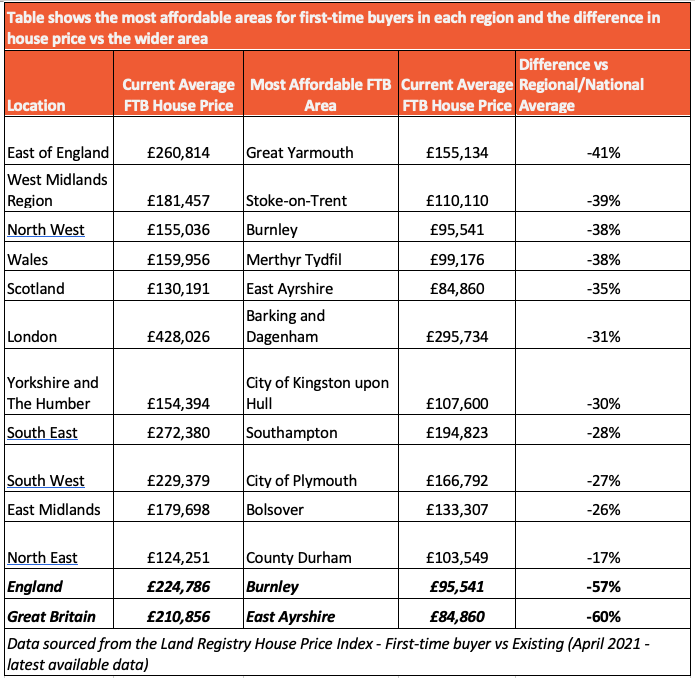

To identify where first-time buyers (FTB) still have a good chance of securing a home, international real estate firm Keller Williams UK has studied the data from each region of Great Britain to identify the least and most affordable locations for first-time buyers in each area.

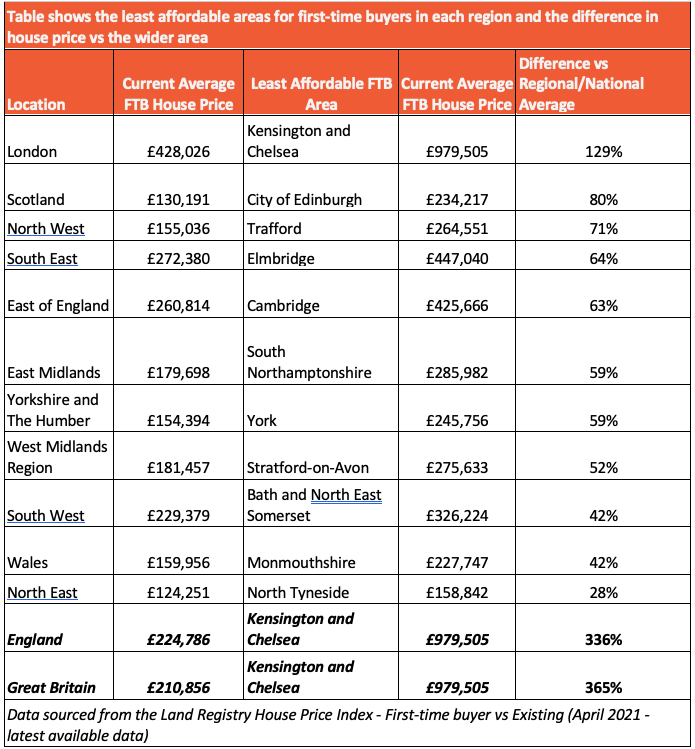

Data from Keller William’s research has revealed that the most affordable area to buy out of all the British regions is the North East where the average first-time buyer house price is £124,251. The most affordable area within that region is County Durham where the current average first-time buyer purchase price is £103,549 – that’s c.17 per cent less than the regional average. By contrast, the least affordable area in the North East region is North Tyneside where the average first-time buyer home costs £158,842, which is 28 per cent higher than the regional average.

However not everyone wants to move up north to buy their first home, many homebuyers will want to stay in their current region so let’s take a look at how the other British regions compare…

In the East of England, the research found that the average first-time buyer home costs £260,814. The most affordable place in the area is Great Yarmouth, where the average first-time buyer home can be bought for £155,134, which is 41 per cent less than the regional average.

The East’s least affordable location is Cambridge where an average first-time buyer pays £425,666 for their property, making it 66 per cent more expensive than the regional average.

The Best FTB House Prices in the West Midlands

Keller Williams’ research, which used Land Registry House Price Index data to compare first-time buyer prices with existing average regional prices, found that in the West Midlands, where the average first-time buyer home costs £181,457, buyers looking for low house prices in the region should head to Stoke-on-Trent where they can get on the property ladder for an average price of £110,110, which is 39 per cent below the regional average.

The West Midlands’ least affordable location was revealed as Stratford-upon-Avon where the average price of £275,633 is 52 per cent higher than the regional average.

In the North West region, the average first-time buyer home comes in at £155,036. The region’s most affordable location is Burnley, Lancashire, where the average home costs just £95,541, which is 38 per cent below the regional average and 57 per cent below the average first-time buyer home across the whole of England.

The least affordable location in the North West is Trafford, Greater Manchester, where the average price of £264,551 makes it 71 per cent more expensive for a first-time buyer compared to the regional average.

Record House Price Growth in Wales but Still Some Bargains to Be Had

Nowhere in Britain has the housing market seen more dramatic change over the past 18 months than Wales – prices here have risen more than anywhere else. But there are still some great opportunities for first-time buyers, not least in Merthyr Tydfil, roughly 20 miles north of Cardiff. Here, the average first-time home costs just £99,176, which is 38 per cent below the Welsh average.

At the opposite end of the spectrum, Wales’ least affordable first-time buyer location is Monmouthshire where an average FTB price of £227,747 makes it 42 per cent more expensive than the regional average.

The House Price Highs and Lows in Scotland

The Scottish regional average first-time buyer home costs £130,191 with the most affordable area to buy being East Ayrshire which is 35 per cent lower than the regional average and a whopping 60 per cent lower than the average first-time buyer price across the whole of Great Britain. The region’s least affordable area was Edinburgh, with first-time buyer homes costing an average of 80 per cent more than the regional average.

London Least Affordable Region for First-Time Buyers

Unsurprisingly, the research found that London is the most expensive region with the average first-time buyer purchase coming in at £428,026. The most affordable area in the London region was Barking & Dagenham with average first-time buyer prices 31 per cent less than the regional average. The least affordable London area was Kensington & Chelsea, with an average FTB house price being £979,505 – some 129 per cent higher than the regional average, 336 per cent higher than the average first-time buyer price in England and 365 per cent higher than first-time buyer price across the whole of Great Britain.

Other Regional House Prices in Brief

- Yorkshire & Humber (Ave. £154,394) Most Affordable = City of Kingston upon Hull (-30%); Least Affordable = York (+59%)

- South East (Ave. £272,380) Most Affordable = Southampton (-28%); Least Affordable = Elmbridge (+64%)

- South West (Ave. £229,379) Most Affordable = Plymouth (-27%); Least Affordable = Bath and North East Somerset (+42%)

- East Midlands (Ave. £179,698) Most Affordable = Bolsover (-26%); Least Affordable = South Northamptonshire (+59%)

CEO of Keller Williams UK, Ben Taylor, commented: “For first-time buyers, location might be more important than anything else, not least for those who are looking for so-called starter homes but don’t want to move too far away from the workplaces or communities they have come to love.

“It’s great, therefore, to be able to show that amazing deals can still be found without having to sacrifice too much on your desired location. First-timers who want to buy in Trafford, for example, only have to move 35 miles away to Burnley in order to save almost £170,000. The same distance applies to buyers in Monmouthshire who can save £129,000 by instead buying in Merthyr Tydfil.

“We live on a small island and this data shows how we have incredibly varied housing markets situated next door to one another. First-time buyers don’t have to compromise too much on their desired location in order to land a great deal.”

The research also shows how buyer preferences are changing as a result of changing work patterns and life choices brought on by the COVID-19 pandemic. In the South East, for example, where one would assume the most affordable areas to also be the most rural, the research shows the opposite is now true with the most affordable location being the city of Southampton, while the least affordable is Elmbridge, an area of small countryside towns with direct links to London.

“It’s clear that first-time buyers no longer want to live in the hustle and bustle of big cities, but still want easy access to them when needed,” Taylor explained.

Are you a first-time buyer? Where have you been able to afford to buy in your region?