Property InvestmentProperty News

Property Rental More Affordable than Property Ownership Research Uncovers

In a revelation that challenges long-held beliefs about the benefits of property ownership, new research has unearthed a significant trend across the UK: for the majority of regions, opting to rent rather than buy for first-time buyers is now the more economical choice.

Over the last decade, the cost of owning a property for first-time buyers has surged by 113 per cent while rental costs have increased by 82 per cent. This change has resulted in a scenario where, in the vast majority of the UK, renting is the financially smarter choice.

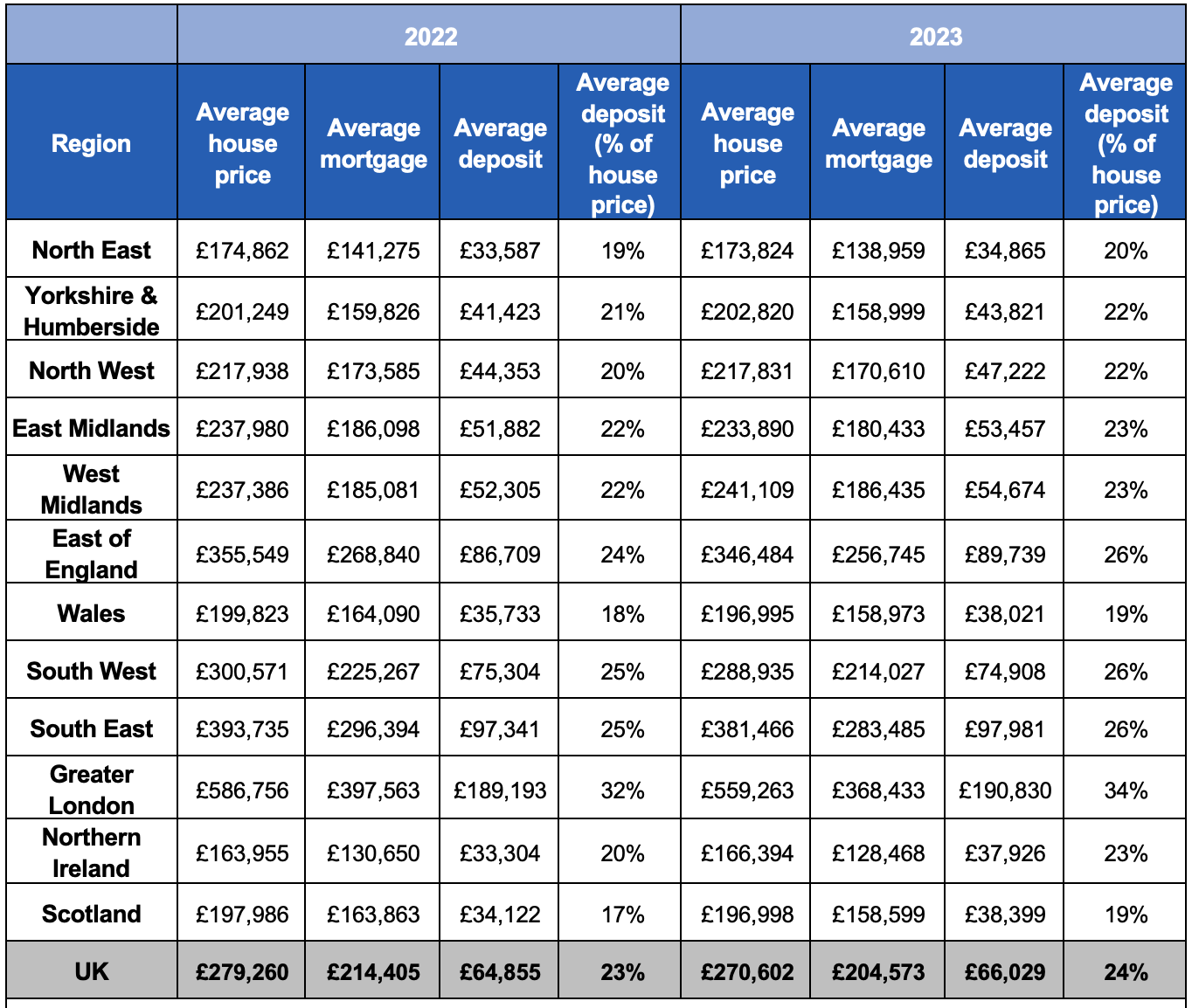

This has proven true in nine out of 12 of the UK regions where the new research has found that the monthly cost of owning a first home compared to the equivalent rental cost, was higher, with renters making the biggest savings compared to first-time buyers in the East of England, where they are an average £2,325 better off each year.

Renters in the South East were also found to be better off by £1,859 per annum, while in the East Midlands renting is £1,741 more affordable. Renters in Yorkshire & the Humber also enjoy significant yearly savings of £1,731 per year when compared to owning a first home. See table 1 below for more regional data.

Table 1: UK average monthly home-owning and rent costs by region

The South West, London and Scotland were the only regions where the research found owning a first home is cheaper than renting. The largest annual savings were in the South West where owners were found to be on average £1,663 better off.

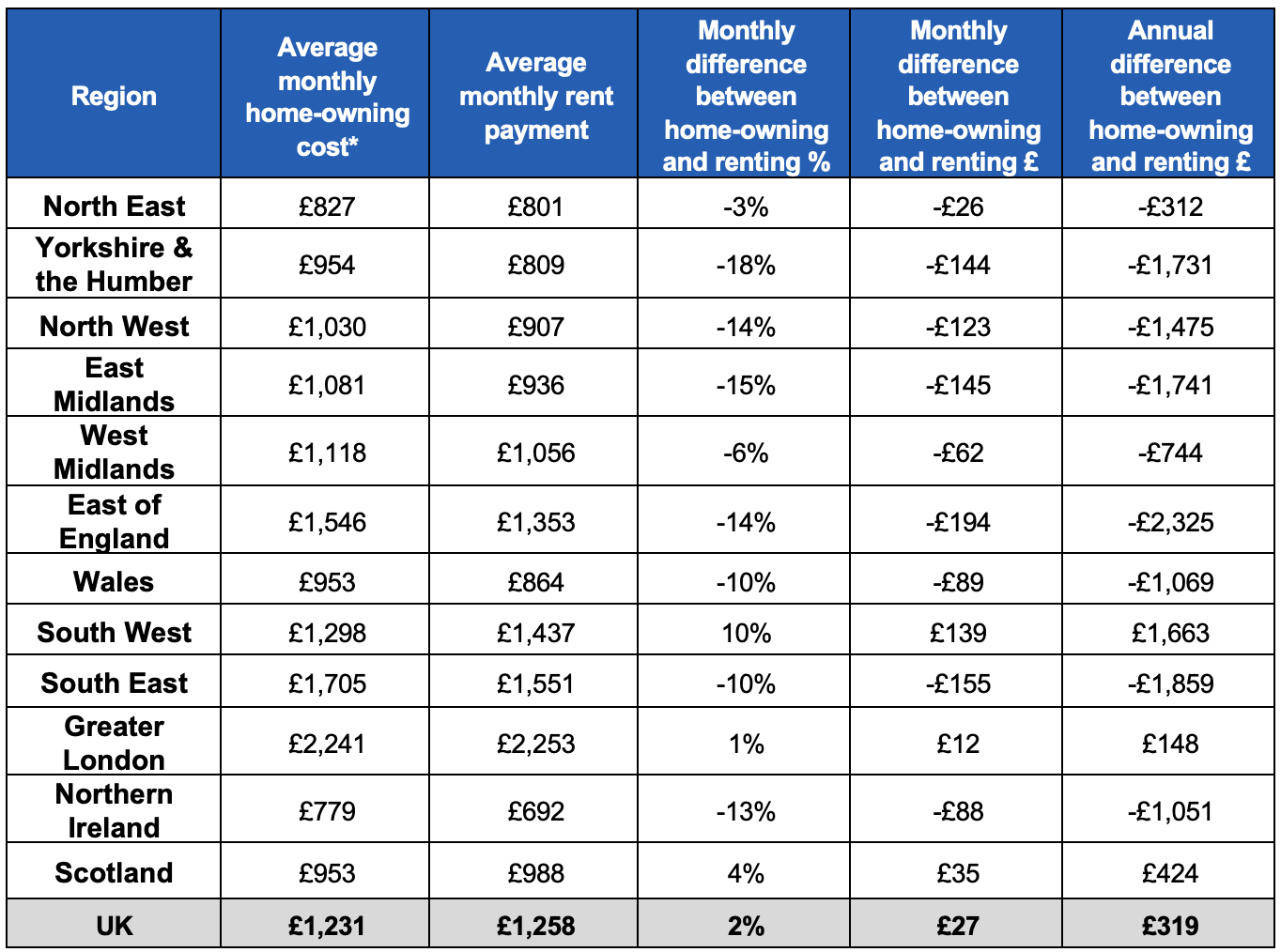

Nationwide, the average monthly cost for first-time buyers owning their first property was marginally lower at £1,231, just £27 less than renting an equivalent property (Table 2) .

This is the smallest gap between the cost of home ownership and renting since 2019 according to the latest Halifax Owning vs Renting Review.

The analysis, based on the housing costs associated with a mortgage on a three-bed property compared to the average monthly rent of the same property type, found that monthly rental costs in 2023 grew by 24 per cent to £1,258, while home-owning costs grew by 27 per cent to £1,231.

Table 2: UK average monthly home-owning costs and rent payments

Despite the economic tilt towards renting, Halifax’s researchers point out that there remain many advantages to owning a property, saying that as well as the average nationwide annual savings of £319, compared to renting, home ownership can offer long-term financial stability.

There is also the matter of inflation, as house prices have followed an upward trajectory for many years.

However, this new research may be good news for landlords and property developers, as the shortening gap between rental costs and ownership indicates a notable shift in the UK housing market, making renting a more attractive proposition than buying for first-time buyers in nearly all regions.

Kim Kinnaird, Mortgages Director at Halifax, emphasised the significance of these findings showing that the current economic landscape has made renting a more viable option for first-time buyers across most of the UK, save for a few regions. Despite these challenges, Kinnaird reaffirmed Halifax’s commitment to supporting prospective homeowners through government schemes aimed at making home ownership more accessible, saying: “We know home ownership can offer long-term financial and living stability and that’s why we believe it’s an important step to take. Our customers want to create a secure future, so it’s a big priority for us to help people get there.”

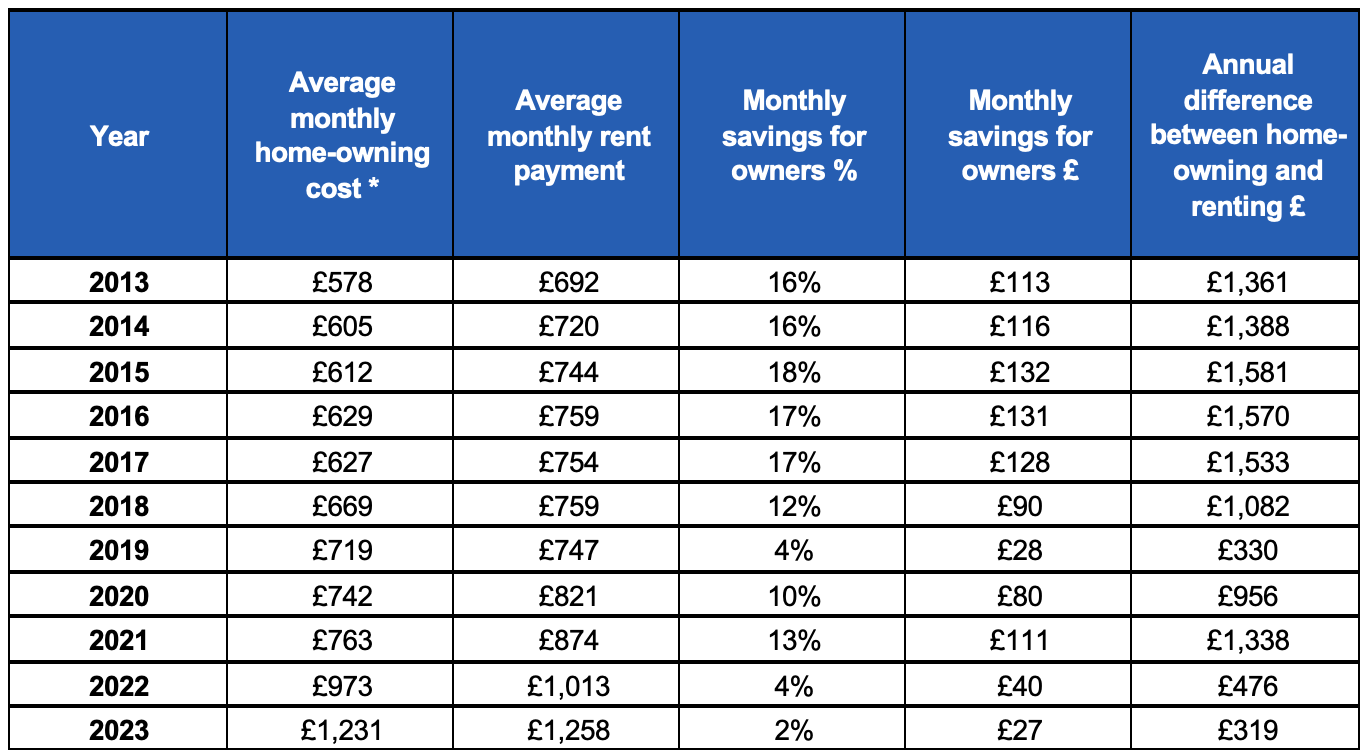

Halifax’s Data on first-time buyer mortgage purchase data is below.

Table 3: First-time buyer average house price, mortgage advance and deposit, 2022, 2023