Property Investment

Property Prices Rises Show No Sign of Slowing Despite Cost of Living Crisis

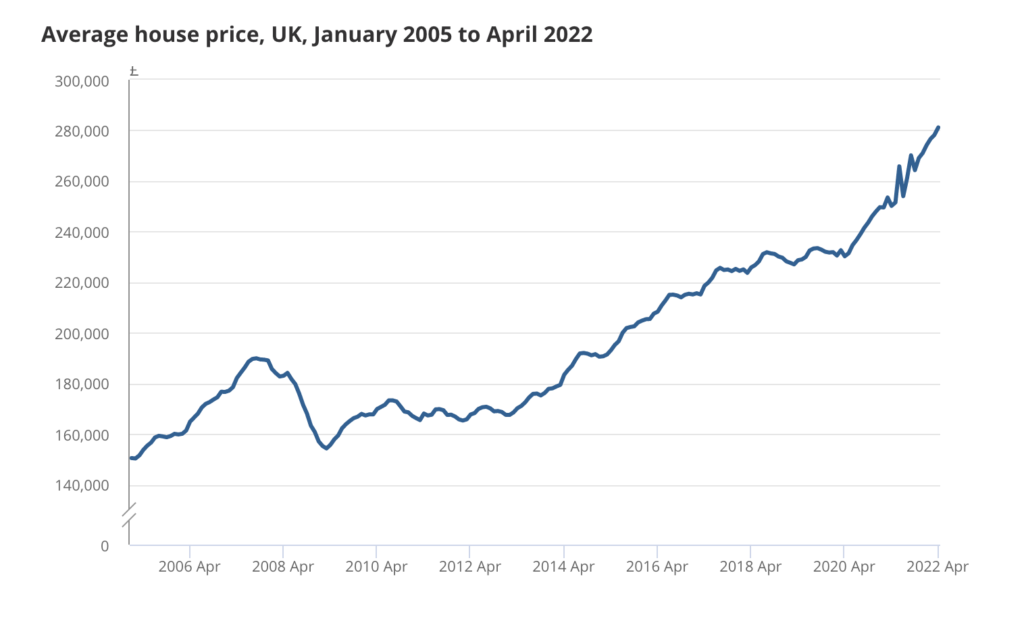

New figures from the Office for National Statistics show that property prices are continuing to rise, increasing by 12.4 per cent over the year to April 2022, up from 9.7 per cent in March 2022.

In April 2022, the average price of a property in the UK cost £281,000 – this was up £31,000 from the same period in April 2021.

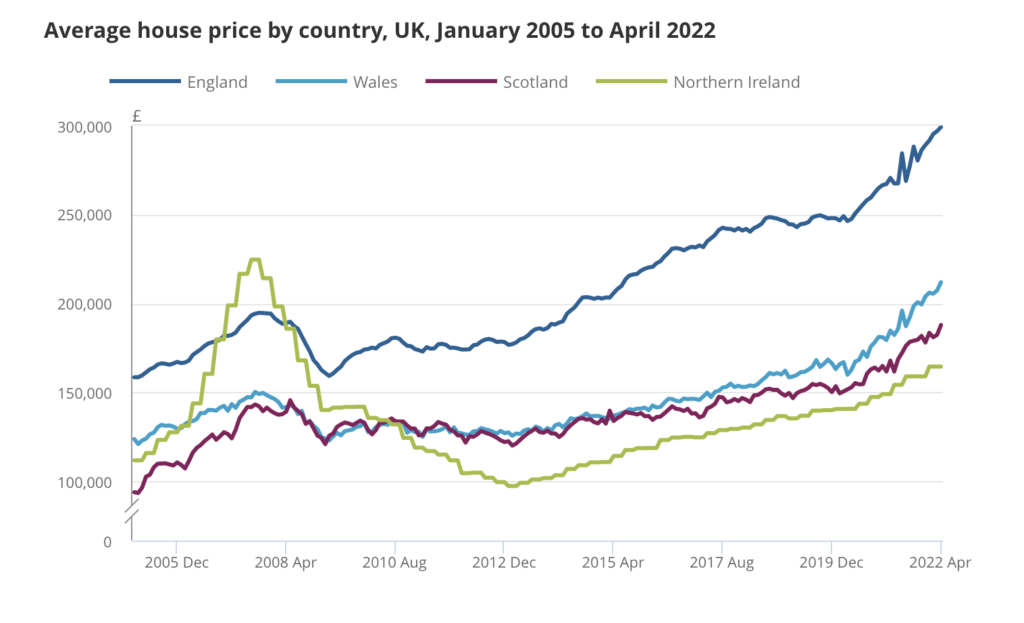

Buy country, over the course of the year the average price of a property in England rose 11.9 per cent to £299,000, in Wales by 16.2 per cent to £212,000, in Scotland by 16.2 per cent to £188,000, while in Northern Ireland the price rise was more modest at 10.4 per cent to £165,000.

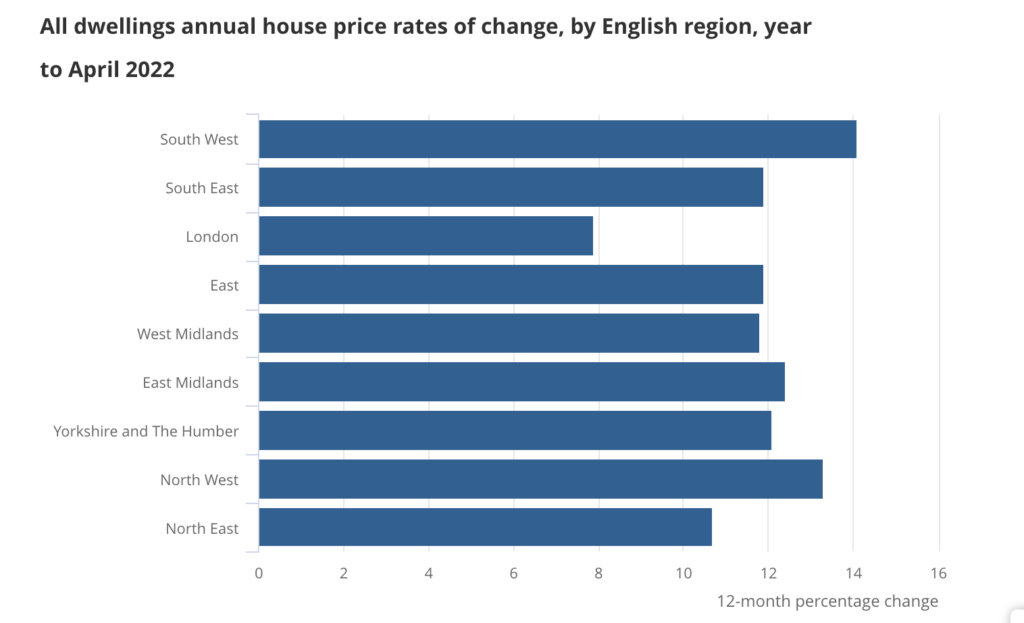

The region with the highest annual house price growth was the South West, with average prices increasing by 14.1 per cent in the year to April 2022. This was up from a growth rate of 10.5 per cent in March 2022.

With an annual growth rate of 7.9 per cent, London is still the region with the lowest growth however with the average price of properties sitting at £530,000 in April 2022 the Capital is still the most expensive of any region in the UK. By contrast, the North East continues to have the lowest average house price of £155,000.

Nick Leeming, Chairman of Jackson-Stops, commented: “Despite significant economic headwinds coming down the tracks, bricks and mortar is defying gravity. But as the stamp duty holiday heyday tails off from annual figures, and higher interest rates with record inflation start to moderate demand, a cooling-off period from recent peaks is widely anticipated by the end of the summer. Stretched affordability issues could result in some additional sales by the end of the year, however, the government seems keen to keep the lending market agile having recently dropped the minimum stress test. Therefore, house price growth is likely to remain but at a more manageable rate. This steadying of the market will be a relief to many.”

Meanwhile, new data from property analysts at Rightmove has revealed that the average price of property coming to market has hit yet another new record for a fifth consecutive month, rising by 0.3% (+£1,113) to £368,614. However, this is the smallest increase since January, which the researchers say indicates a softening in the market.

Tim Bannister Rightmove’s Director of Property Science commented: “The exceptional pace of the market is easing a little, as demand gradually softens and price rises begin to slow, which is very much to be expected given the many record-breaking numbers over the past two years. When we look at the number of buyers contacting estate agents compared to 2019 or the pre-pandemic five-year average, demand is still very high compared to what was once considered normal. We’re hearing from agents that though they might have had slightly fewer enquirers for each property in recent months, they’re still seeing significant interest from multiple buyers and are achieving successful sales. Entering the second half of the year, we anticipate some further slowdown in the pace of price rises, particularly given the worsening affordability challenges that people are facing. We expect this to bring the annual rate of price growth down from the current 9.7% towards the 5% increase that Rightmove predicted at the beginning of the year.”