Property InvestmentProperty News

Property Market Hotspots ‘100 Days Into Lockdown’

This past Wednesday, 1 July, marked a very special milestone; the date signalled 100 days since the UK went into lockdown as the Coronavirus pandemic swept across the country, effectively bringing the UK housing market to a grinding halt. However, despite this huge industry setback, some areas of the country have continued to perform well under lockdown (23 March to 30 June) while others have been faster to bounce back since the lockdown restrictions on the property market were eased on the 13 May. New research looking at which UK towns and cities have fared the best since that fateful UK-wide market closure on 23 March has been released. We take a look at the statistics…

Estate agent comparison site, GetAgent.co.uk has collated data on which pockets of the UK property market have weathered the Coronavirus storm the best. GetAgent based its assessment of market performance on an area’s resilience for both the available level of property stock listed during the lockdown and the number of new homes entering the market since the industry reopened for business on 13 May.

Using data from all of the major portals, which were then cross-referenced with the Land Registry using their proprietary algorithms and input from partner agents, GetAgent’s research, perhaps surprisingly, shows that each week the number of listings added and the average views each listing received exceeded pre-pandemic levels, while property related searches and home seller leads also continued to climb.

Where is the property market winning 100 days into lockdown?

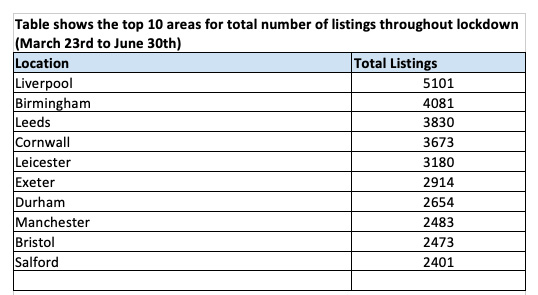

According to the research, Liverpool in the North-West of England has been the UK’s most resilient town throughout the lockdown. The city saw a total of 5,101 properties listed during the 100-day lockdown, the highest across all areas of the UK.

Birmingham in the West Midlands (4,081), Leeds in the northern county of Yorkshire (3,830), Cornwall on England’s southwestern coast (3,673) and Leicester in East Midlands (3,180) also saw some of the highest levels of property stock despite being in lockdown for 100 days.

However, even though Leicester enjoyed a very positive market rebound, local property investors may have to be patient for a few more weeks after the town was forced to go back into lockdown to fight off a concerning increase in Coronavirus cases in the area. Residents have been advised to stay home and all non-essential shops have been closed, once again.

Unfortunately, this type of local lockdown may well become a regular occurrence as the UK fights to quash the virus.

Areas enjoying the biggest return to form

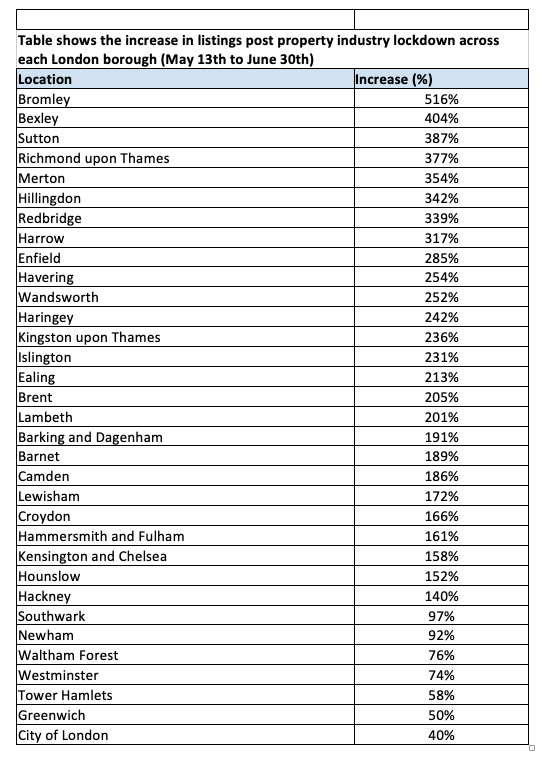

The other positive news for the property market is that stock levels on property portals across the UK have increased by an average of 217 per cent since the property industry reopened in May.

Halton, in Cheshire, has seen the most substantial increase in properties available for sale; the town’s listings have shot up by 833 per cent since the property market reopened on 13 May. Stock levels in Tandridge, in East Surrey (+684%), Waveney in East Suffolk (+673%) and Adur in West Sussex (+642%) followed closely behind top-performer Halton, while Wellingborough in Northamptonshire (+626%), Woking in Surrey (+620%), Broxbourne in Hertfordshire (+613%), North West Leicestershire in the East Midlands (+611%), Eastbourne on the South East coast (+555%) and the London borough of Bromley (516%) completed the table of the top 10 areas seeing the largest market rebounds.

In London, Bexley (+404%), Sutton (+387%), Richmond (+377%) and Merton (+354%) join top-performer Bromley (+516%) as the boroughs to have seen the most significant market revival.

Founder and CEO of GetAgent.co.uk, Colby Short, commented: “For some, it may seem like we entered lockdown years ago, let alone 100 days ago. However, in the vast majority of areas, life has gone on where the UK property market is concerned.

“We saw a vast degree of activity return after restrictions were lifted and it’s been quite remarkable how the sector has pivoted to accommodate this.

“We should see this backlog of activity start to subside over the coming months as normality returns, but we are certainly in a far better place than many predicted a few months back and this looks set to continue for the duration of the year.”