LatestProperty InvestmentProperty News

How Regional Commuter Towns are Rivalling the Capital as Property Investment Hotspots

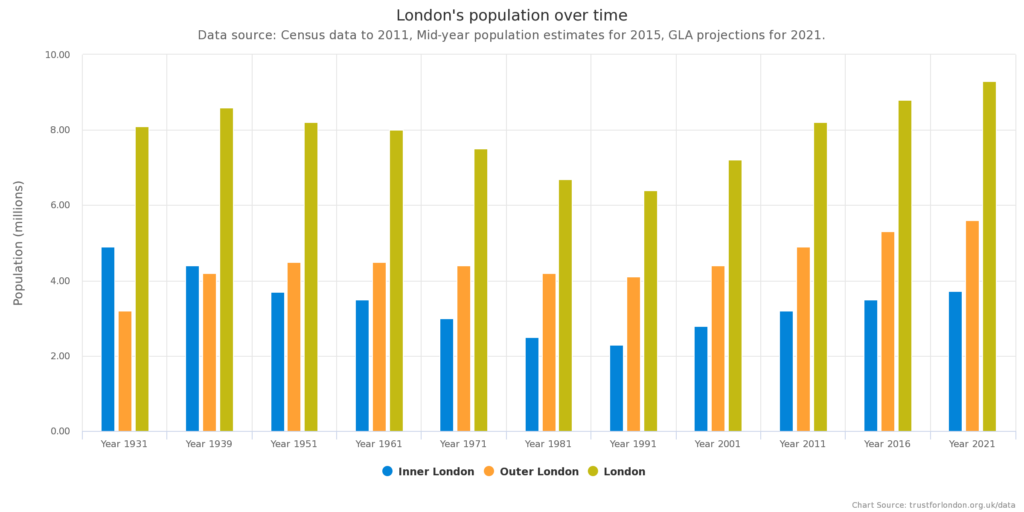

In recent years, London property has been consistently popular with investors due to the strong demand for rental properties as the city’s population grew year-on-year.

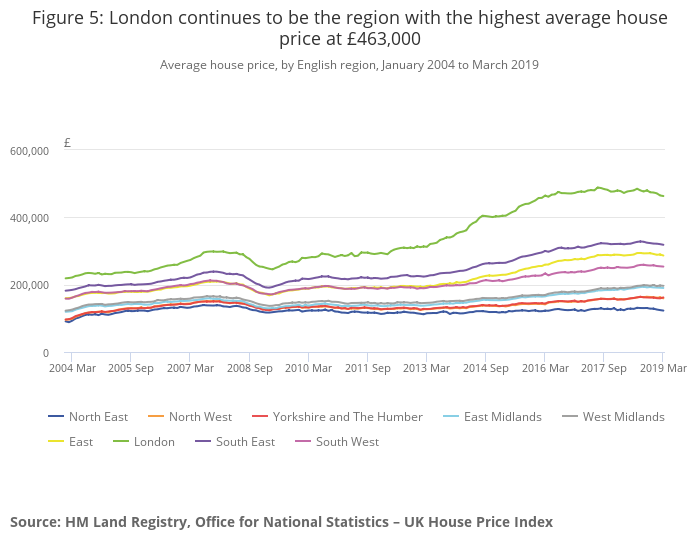

The capital’s properties have not only continued to benefit from high demand, London has also been the go-to city for those looking to make money from significant increases in property prices (capital appreciation). In fact, in January 2004 the average London house price was £219,804; this figure rose to £298,595 in January 2008, then peaked at £488,527 in July 2018, according to Office for National Statistics (ONS) figures. However, although London continues to be the region with the highest average house price currently £463,000 (see chart below), this amount is over 25K lower than the July 2018 figures, meaning capital growth in London is no longer considered a ‘sure thing’. Furthermore, rental prices haven’t been rising in line with property prices meaning rental yields have steadily declined and are typically lower in central London than outer London and the city fringes.

These factors, along with the uncertainty surrounding Brexit, has led to a slight wobble in investor confidence in London’s property market resulting in a shift in buyer activity. Where the capital was once king for investors, regional cities and commuter towns are now beginning to grow in popularity.

London commuter towns gaining popularity

A number of regional towns have been quietly emerging as areas of increasing demand and house price growth, even in the South East, where house sales have suffered due to the flat London market.

Three towns in the south-east emerging as new property investment hotspots are Bicester, Bracknell and Slough according to SevenCapital, one of the largest privately-owned real estate investment and development companies in the UK.

The firm, which has invested in the up-and-coming areas, says all three towns benefit from extensive regeneration and investment projects (planned or underway), lower house and rental prices than neighbouring London and considerable potential for growth. Let’s take a look at what these emerging property hotspots have got to offer.

Bicester

Renowned for its designer shopping outlet, Bicester Village – which it is claimed comes a close second to Buckingham Palace in terms of number of visits from Chinese tourists – this vibrant Oxfordshire market town lies just 15 minutes from the centre of Oxford and around 45 minutes from central London so is perfectly located for commuters who work in either city.

Bicester is currently enjoying £millions worth of investment through its status as a ‘Garden Town’ and Cherwell District Council’s 20-year ‘Growing Bicester’ initiative, which includes the development of a groundbreaking new ‘green’ village, Graven Hill, comprising a range of self-build homes and buy-to-let apartments.

Bicester’s major advantage over London and Oxford is the house prices: average house prices* in Oxford and London currently stand at £510,753 and £729,105 respectively while houses in Bicester are a much more affordable £329,165.

Furthermore, due to its location along the growth corridor between Oxford and Cambridge, Bicester has been named as ‘one of the fastest growing economic centres in Oxfordshire’. As a result, the town’s population is predicted to nearly double by 2032, from 30,000 to 50,000 – good news for investors.

Bracknell

Sitting in the heart of the ‘UK’s Silicon Valley’, Bracknell is also enjoying a significant amount of investment. However, the town is growing in appeal for very different reasons to Bicester. In recent years, Bracknell town centre has been completely transformed by the arrival of The Lexicon – a £240 million, one million square foot retail and leisure destination which boasts top retailers such as Fenwick, Waitrose, Joules, L’Occitane and Marks & Spencer as key tenants.

Not only that, Bracknell is also considered a top centre for technology companies, as well as being home to one of the highest proportions of workers** (16.2%) employed by the biggest companies in Britain – double the UK average of 8.4%.

Located near to Ascot and the famous Ascot Racecourse, Bracknell is also only an hour’s commute from London, however with average house prices* in nearby Ascot currently c.£826,804 – higher than the London average, Bracknell offers an opportunity to buy at less than half the price (£362,338).

Slough

Slough has already seen significant investor interest over recent years due to its location along the anticipated Crossrail railway line into central London. Just 18 minutes direct by train into London Paddington, Slough has already been named twice as a top place to live and work by leading UK recruitment platform Glassdoor and was recently named in the top three most popular locations for London commuters.

More than simply location though, Slough’s appeal is growing so fast due to a £1 billion, 15-year regeneration project that started back in 2012 and has already delivered key commercial and community developments such as The Curve, an ultra-modern library and community arts facility. It’s also set to benefit from the Western Rail Access to Heathrow (WRAtH), which will see access to Heathrow Airport in as little as six minutes, and, importantly, as a key commercial centre, the town is home to the largest concentration of global businesses in the UK outside of London, including O2 Telefonica, Ferrari and Mars.

Despite house prices rising by more than 66% per cent since the announcement of Crossrail in 2009, the town remains more affordable than London, with a current average house price of around £400,000.

Andy Foote, Director at SevenCapital, said: “We’re seeing smaller pockets of the country starting to redevelop and emerge as important commercial, retail and technology hubs with serious potential for high, consistent growth far into the future.

“We’ve already seen increasing interest in Bicester amongst our client base, due to its proximity to London, Oxford and Cambridge and a very good entry point versus projected growth. I expect the same will start to happen with Slough and Bracknell and other areas surrounding the London commuter belt.”

For savvy property investors, areas such as Bicester, Bracknell and Slough all represent the new wave of UK investment hotspots that offer lower entry price for investment, higher proportionate capital growth potential than their counterparts and the ability to generate higher rental yields due to the better affordability for tenants.

Are you investing in a potential new property hotspot? We’d love to hear.

*source Rightmove

**according to ONS figures in 2016