LatestProperty Investment

UK House Prices Set to Rise By 8.1% in Post-Lockdown Boom

An exceptional level of homebuyer demand since the COVID-19 lockdown was eased has driven a significant spike in house price growth, new research has found.

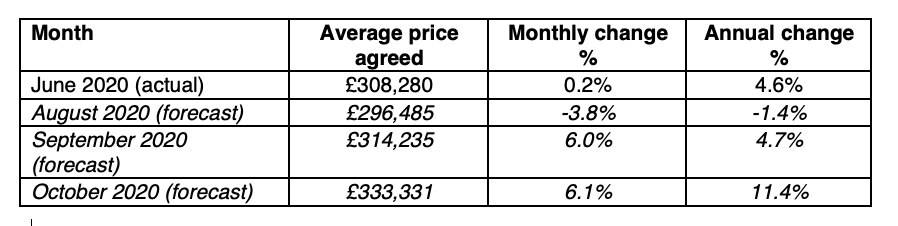

According to the new data, average house prices in England and Wales are on course to increase by 8.1 per cent from £308,280 to £333,331 between June and October [table 1].

However, before the predicted boom hits, annual growth is set to dip by 1.4 per cent in August 2020 [table 1] reflecting the spring COVID-19 property market freeze, this represents the first annual price fall in thirteen months. The market is then set to rebound strongly in September with average house prices rising to £314,235 (a +4.7 per cent annual change) and then rising again to £333,331 in October (an 11.4 per cent annual change), with October’s data representing the most significant year on year increase in house prices seen since the House Price Forecast began in January 2013.

A perfect storm of factors has led to the remarkable levels of housing market activity England and Wales are experiencing this summer… People’s dissatisfaction with the size and outdoor space offered by their existing homes during the Coronavirus lockdown, the significant pent-up demand from the spring when the market was stopped in its tracks, topped off by the Chancellor’s introduction of a temporary stamp duty discount on 8 July have combined to provide a huge incentive to buyers to move now, rather than wait.

The House Price Index from price comparison site reallymoving is in a unique position to report property price trends before they happen, as its figures – although not whole of market – are based on data from 20,997 completed conveyancing quote forms between May and July 2020 that are typically received three months before completion, thereby providing an early prediction of emerging house price trends that the Land Registry will see and report in August through to October 2020.

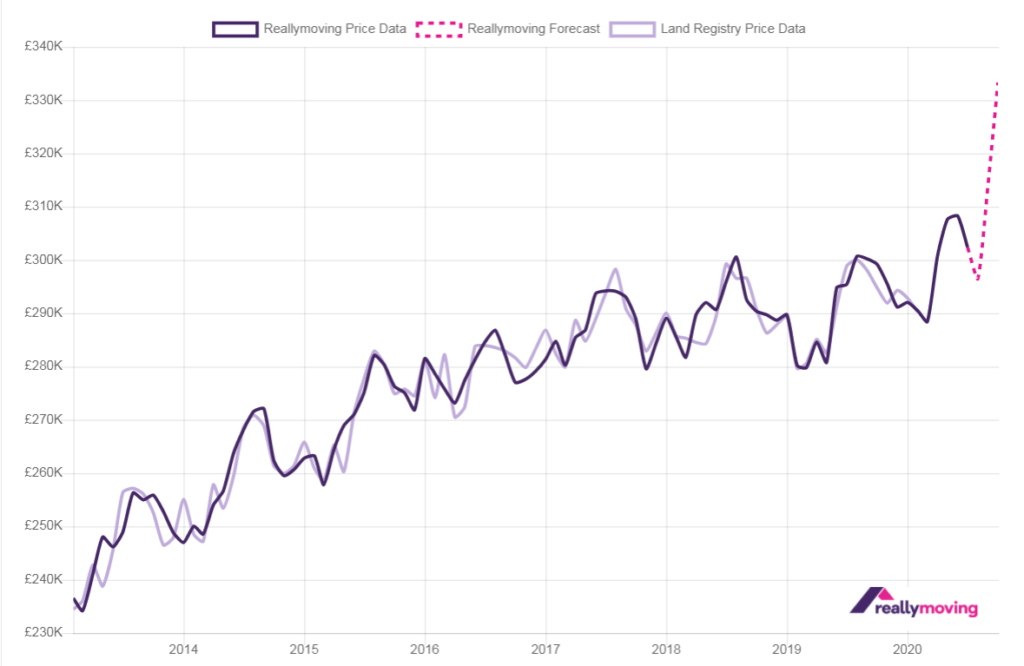

Historically, reallymoving’s market data has closely tracked the Land Registry’s ‘Price Paid data’ (as can be seen in Graph 1), which is published retrospectively.

Graph 1: reallymoving House Price Index (England and Wales) including 3-month price forecast

Monthly House Price Changes

The trend of post-lockdown growth is clear in the graph and shows a significant monthly surge in the value of deals agreed between buyers and sellers in June which is set to translate into 6 per cent growth when those deals complete in September and a further 6.1 per cent rise in October.

Similar reports of heightened buyer demand have also been reported across the market, with Countrywide, one of Britain’s largest estate agency groups, noting a 38 per cent increase in buyers since the stamp duty announcement.

Although the figures indicate a significant uplift in house prices, this house price boom could well be short-lived if the wider economy and jobs market struggle to recover when the Government’s extensive COVID-19 support measures are completely phased out. Furthermore, when the stamp duty discount reverts back to the customary higher rates at the end of March 2021, it is likely demand will drop down to more usual levels.

Rob Houghton, CEO of reallymoving, agrees there may be some more challenging times ahead for the property market: “The UK is now officially in recession and a sharp rise in unemployment is on the horizon when the furlough scheme comes to an end in October. Combined with the recommencement of mortgage repayments for thousands of homeowners who arranged payment holidays, households could find themselves under significant financial pressure. These factors will dampen demand for property through the late autumn and winter, which is likely to reverse the current spike in house price growth.”

With the market so volatile at the moment, we wonder whether the recession this autumn will actually be accompanied by a fall in house prices as predicted by reallymoving’s CEO above or whether prices will hold strong until April when the stamp duty relief ends. It will be interesting to see.