Property InvestmentProperty News

High Demand Continues to Drive Property Prices Up

House prices in the UK climbed by 10.8 per cent in 2021, taking the average property price to £274,712 new research from the Office for National Statistics (ONS) has revealed. Their December data also shows that on average, house prices have risen 0.8 per cent since November 2021.

House Price Growth by Country

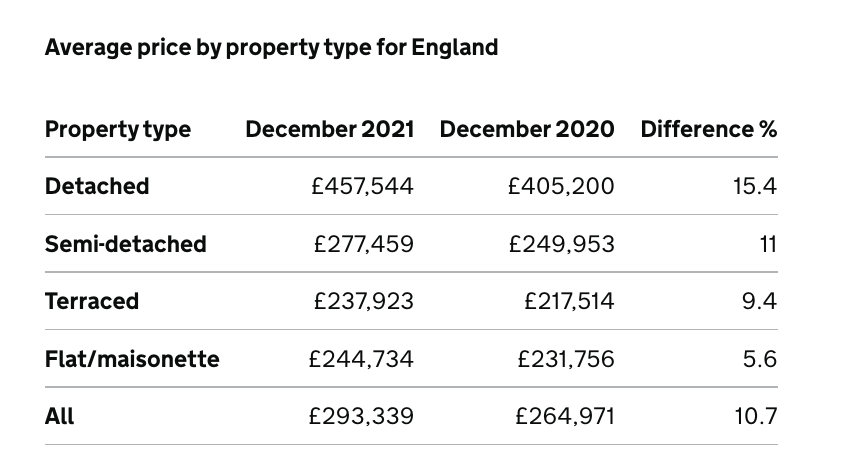

According to the UK house price index figures from the ONS, over the past year, average property prices in England have climbed by 10.7 per cent to £293,339 with average prices across the country rising 1.1 per cent since November 2021. Detached properties have seen the most significant increases by property type with prices up 15.4 per cent from 2020 numbers.

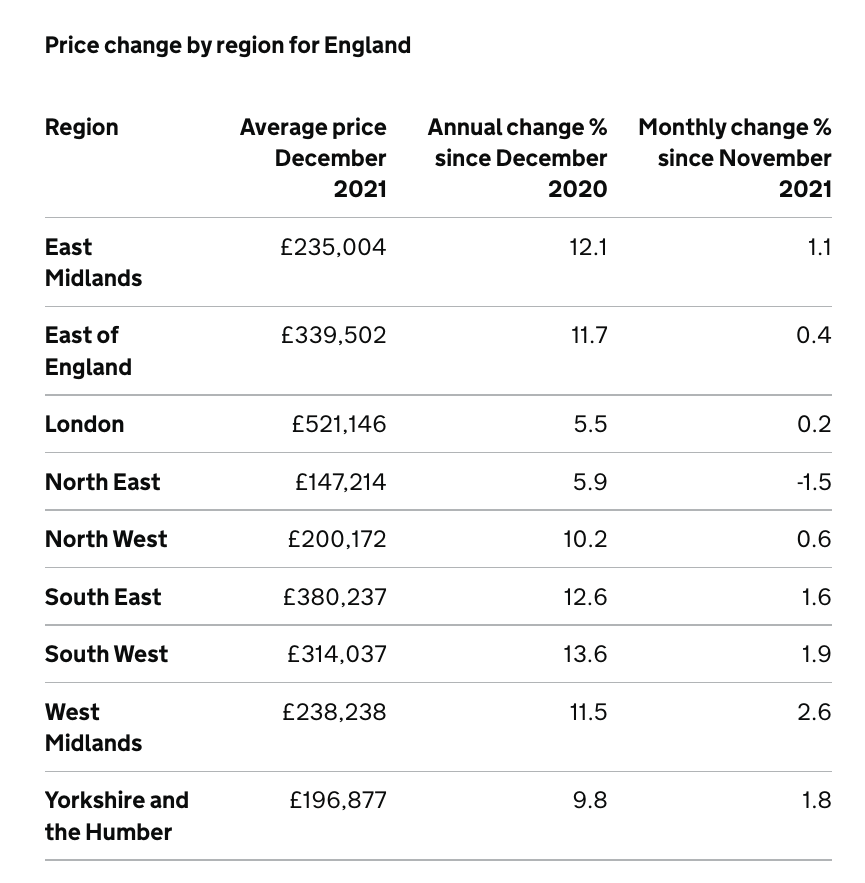

Out of the English regions, the West Midlands saw the biggest monthly increase in average house price rises since November, a 2.6 per cent increase (year-on-year + 11.5%). By contrast, the North East saw a price fall of -1.5 per cent with only a moderate, 5.9 per cent, gain over the course of the year.

The region with the biggest annual house price growth was the South West, with a 13.6 per cent increase since 2020, while the region with the lowest house price growth was London with an annual change of just 5.5 per cent.

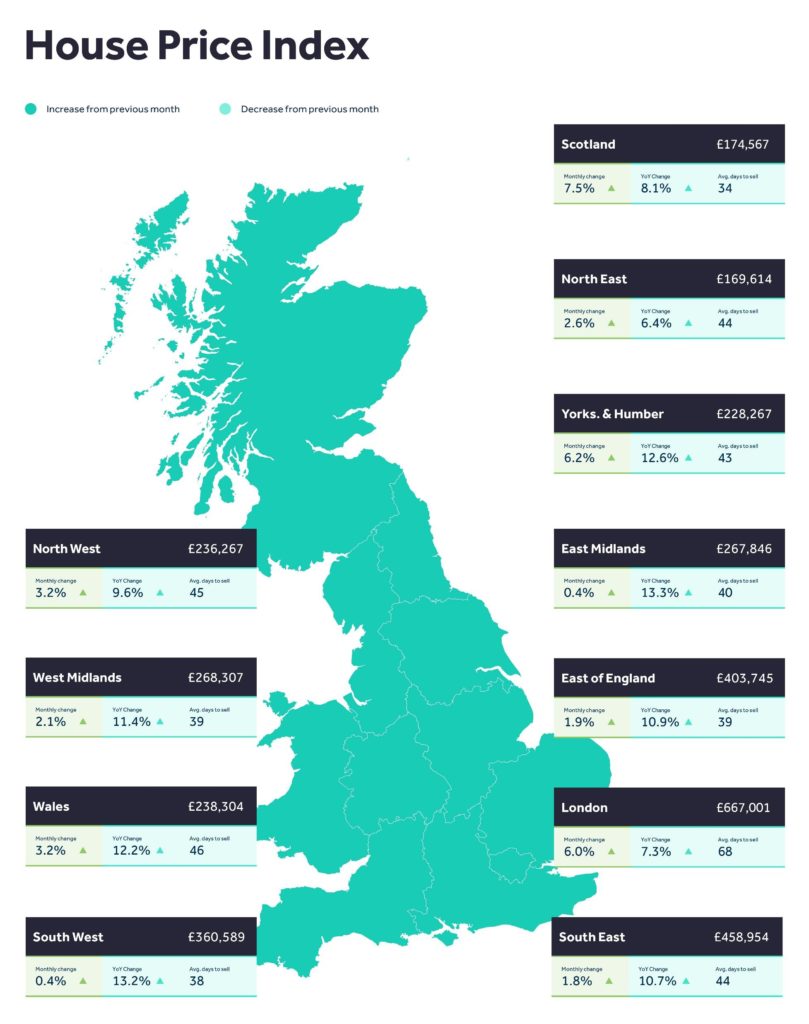

In Wales, average house prices increased by 13.0 per cent year-on-year, while in Scotland average house prices rose by 11.2 per cent and in Northern Ireland, the year-on-year rise was 10.7 per cent.

House Price Growth in 2022

The ONS house price research is also backed up by new data from Rightmove released today (21/2/22) which reveals house prices are 9.5 per cent higher than a year ago, the highest annual rate of growth seen since September 2014, according to the property portal’s analysts.

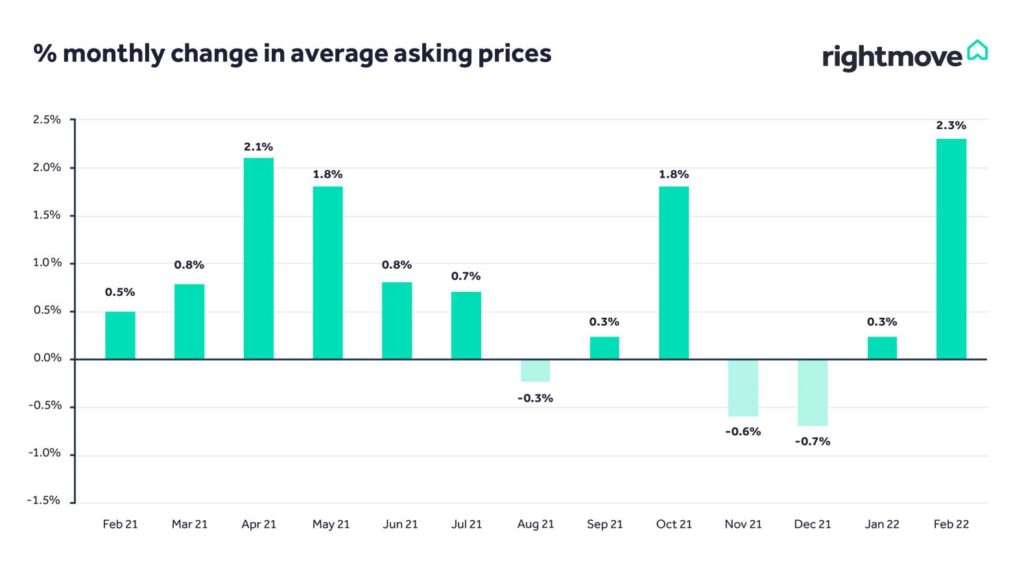

Rightmove’s latest House Price Index also shows that the price of property coming to market has risen by 2.3 per cent this month to £348,804 (+£7,785), setting a new record as the biggest monthly jump recorded by Rightmove in more than twenty years:

The month of February picks up where January left off by outperforming its predecessor. New seller asking prices hit a new high of £348,804 this month, up 2.3 per cent (+£7,785). Normally, asking prices rise in February after a month of declines, but this is the largest monthly increase in cash terms that Rightmove has seen in more than two decades of monitoring, and the yearly rate of asking price growth (+9.5 per cent) is the highest since September 2014. In the two years since the pandemic began, average asking prices have increased by about £40,000, compared to a little over £9,000 in the preceding two years.

The property portal analysts says that the epidemic is still influencing many house purchases, with the “second stepper” segment – people who may require more space and are ready to move on from their first residences – driving this month’s price increases.

Furthermore, as the return-to-work trend picks up following the end of the pandemic restrictions, London has seen the largest increase in the number of buyers sending inquiries of any region (+24%), setting a new price record and the highest annual rate of price growth since 2016.

Tim Bannister, Rightmove’s Director of Property Data comments: “The data suggests that people are by no means done with their pandemic-driven moves. Such a significant societal event means that even two years on from the start of the pandemic, people are continuing to re-consider their priorities and where they want to live.”

James Forrester, Managing Director of Birmingham estate agent Barrows and Forrester, commented: “There’s certainly been no let-up in the sheer volume of buyers swamping the market and we continue to see high numbers fighting it out for a very limited level of stock, the result of which is an inevitable boost to property values.

However, we’re also seeing sellers pre-empt this high demand and enter the market at a far higher price point to take advantage of this buyer desperation and this has pushed asking prices up at their highest monthly rate in over two decades.”