Property News

Fewer Buy-to-Let Properties Boosts Rental Growth Across UK

Reduced landlord investment in buy-to-let properties has virtually doubled rental growth in 2019. As we noted in our 2020 outlook review, the falling number of new landlord purchases has meant the number of homes available to rent has dropped, particularly in London and the South over the past few years. This lack of new supply has boosted rental growth by almost double in 2019, Hamptons International’s latest Monthly Lettings Index has revealed.

UK-wide, there were actually 7.8% fewer properties available to rent during the first 11 months of 2019 compared with the same period in 2018. In the South of England, where more landlords have sold up, there were actually 11.7% fewer homes available to rent.

This increased scarcity of rental properties has driven the average cost of a rental home up 2.1% year-on-year as of November 2019, that’s nearly double the 1.1% recorded in November 2018 (see tables 1 & 2). Furthermore, the average rent of a newly let home in November 2019 rose to £989 pcm, £20 more a month compared with the same time in 2019 (table 1).

Table 1 – Average rent of new lets (pcm)

| Region | Nov-19 | Nov-18 | YoY |

| Greater London | £ 1,724 | £ 1,705 | 1.1% |

| South West | £ 851 | £ 801 | 4.2% |

| South East | £ 1,076 | £ 1,034 | 4.1% |

| Scotland | £ 673 | £ 664 | 1.5% |

| Midlands | £ 694 | £ 686 | 1.2% |

| North | £ 641 | £ 640 | 0.2% |

| East | £ 984 | £ 959 | 2.6% |

| Wales | £ 671 | £ 658 | 2.0% |

| Great Britain | £ 989 | £ 969 | 2.1% |

Source: Hamptons International

Southern regions recorded the strongest rental growth in 2019. Rents in the South West rose 4.2% year-on-year in November, followed by the South East (4.1%) and the East of England (2.6%). Meanwhile, the North recorded the weakest rental growth of 0.2%, followed by Greater London (1.1%).

Table 2 – Regional rental growth

| Nov 2019 | Nov 2018 | Nov 2017 | Nov 2016 | |

| Fastest growth | South West | East | Midlands | East |

| South East | Scotland | North | North | |

| East | Wales | Scotland | Scotland | |

| Wales | South West | Wales | South East | |

| Scotland | North | East | South West | |

| Midlands | Midlands | South West | Midlands | |

| Greater London | South East | South East | Greater London | |

| Slowest growth | North | Greater London | Greater London | Wales |

| Great Britain (2.1%) | Great Britain (1.1%) | Great Britain (1.2%) | Great Britain (2.4%) | |

| Great Britain Exc London (2.5%) | Great Britain Exc London (1.7%) | Great Britain Exc London (1.6%) | Great Britain Exc London (3.2%) |

Source: Hamptons International

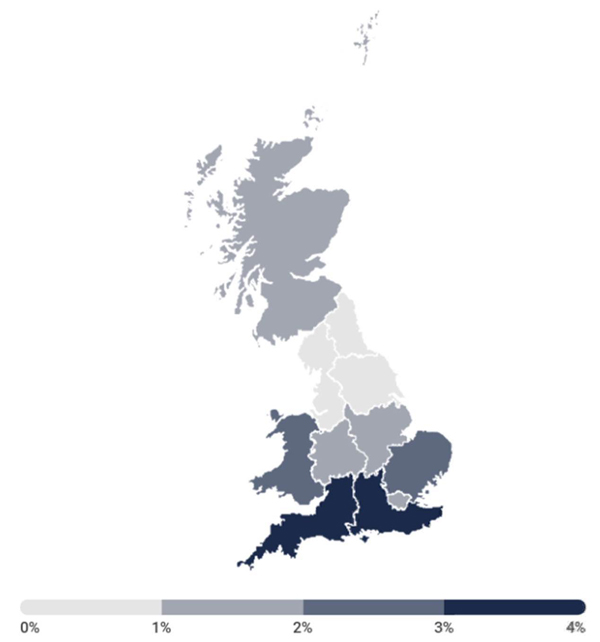

Map 1 – Regional rental growth November 2019

Source: Hamptons International

Although landlord purchases remained subdued throughout 2019, there are signs that investors are starting to return to the market, particularly in London. During the first 11 months of the year, landlords bought 11% of homes sold in Great Britain, the same level as last year, but 5% lower than in 2015. However, in November alone, the proportion of homes bought by investors increased to 12% nationwide (see table 3 below).

Table 3 – Proportion of homes bought by landlords

| First 11 months of each year | November of each year | ||||

| GB | London | GB | London | ||

| 2013 | 15% | 16% | 14% | 16% | |

| 2014 | 15% | 16% | 14% | 17% | |

| 2015 | 16% | 19% | 15% | 16% | |

| 2016 | 14% | 16% | 13% | 15% | |

| 2017 | 12% | 14% | 12% | 15% | |

| 2018 | 11% | 11% | 11% | 14% | |

| 2019 | 11% | 13% | 12% | 16% | |

| YoY Change | 0% | 2% | 1% | 2% | |

| 4Y change | -5% | -6% | -3% | 0% | |

Source: Hamptons International

London recorded a bigger rise in landlord purchases. Landlords purchased 13% of homes sold in the capital during the first 11 months of 2019, up from 11% during the same period of 2018 (table 3). This was the first rise since 2015 but is, in part, due to fewer owner-occupiers transacting in the market.

Commenting Aneisha Beveridge, Head of Research at Hamptons International, said: “Rental growth has been driven by a decrease in the number of homes available to rent. The tax and regulatory changes announced in 2016 have resulted in fewer landlord purchases, particularly in the South, causing some landlords to sell up.

“However, after four years of falls, there are now signs that landlords are beginning to return to the market – particularly in London where house price falls and steady rental growth are gradually enticing investors back.”