Property InvestmentProperty News

Demand Soars as UK Property Market Re-Opens for Business

Buyer demand across England soared by 88 per cent after the property market re-opened for business on Wednesday 13th May, new research has revealed.

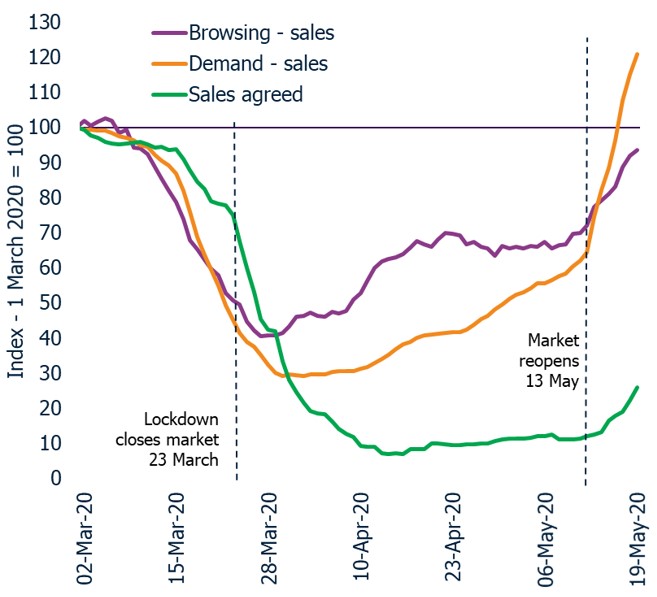

According to the latest UK Cities House Price Index from property platform Zoopla, in the week of the 12th May – 19th May (immediately after lockdown measures were eased) demand for housing in England rocketed 88 per cent to a level 20 per cent higher than that seen at the start of March before the lockdown came into force (Figure 1).

Figure 1: Index of demand, browsing and sales agreed – rolling weekly total

Source: Zoopla Research

This huge uplift in pent-up demand was expected however, especially given the strong start to the year following three years of Brexit uncertainty. The real test of the strength of the recovery will therefore be if this level of interest continues.

At the moment, as figure 1 above shows, unlike buyer demand, other measurements of property market performance are subdued. Although Zoopla’s research shows the level of browsing has significantly rebounded, it is still c.10 per cent lower than pre-lockdown levels while sales agreed, up 12 per cent, are still down c. 88 per cent on levels seen at the beginning of March. Added to this, UK house price growth was flat over April – the lowest monthly growth since January 2019.

So, will the property market fully recover? Zoopla statisticians warn that this post-lockdown property market bounce may be short-lived as a major decline in economic growth and a rise in unemployment levels as a result of the Coronavirus crisis start to impact the market.

Geography matters

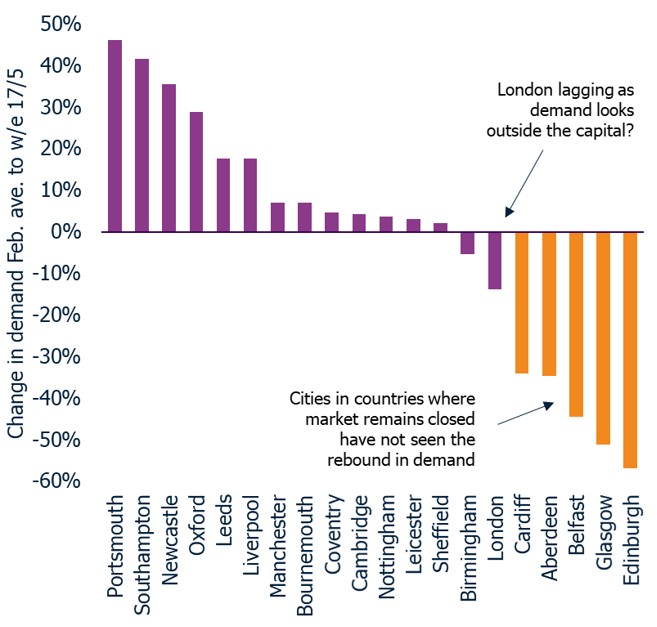

According to Zoopla’s new data, the scale of the bounce back in demand in the week of the 17th of May, varies across cities depending upon the country in which they are located [figure 2]. For example, cities in countries where the housing market is yet to reopen (Scotland, Wales and Northern Ireland) have not yet recorded any major rebound in demand. Furthermore, despite a large rise in demand, London’s recovery is lagging behind. Zoopla suggests this sluggish recovery in the Capital may be because would-be buyers are looking buy in commuter towns outside the capital as their property requirements change in response to the COVID-19 pandemic.

Nigel Purves, CEO of Wayhome the part-own, part-rent, no mortgage homeownership system, explains: “Since lockdown started, many people have had time to re-evaluate their living situation. It’s likely that the pandemic has shifted attitudes toward what is seen as comfortable living – whether that’s access to a garden, office space or simply a quieter area.”

London also relies heavily on foreign buyer demand which will probably not recover until travel restrictions are lifted.

Figure 2: Rebound in demand across UK Cities – daily demand in the week ending 17 May compared to average for whole of February 2020

Source: Zoopla Research

The new research also shows that demand has rebounded faster in cities along the south coast and in northern England, with Portsmouth, Southampton and Newcastle seeing the strongest rise in buyer demand, up 46%, 42% and 36% respectively, in the first week after the market re-opened compared to the February statistics.

Market confidence

The property market is still very much finding its feet following the COVID-19 pandemic lockdown, and there will no doubt be a few challenges along the way. However, the significant rebound in buyer demand does seem to indicate buyer confidence is still strong.

This sentiment is also reflected in a consumer survey by Zoopla that found that some 60 per cent of buyers in the UK are planning to continue with their search for their next home. Of those, 22 per cent said that they have not been impacted by COVID-19 and expect to continue unaffected, while 37 per cent said that despite being impacted to some extent, they were looking to continue with their purchase as soon as possible. By contrast, 41 per cent said they have put their plans on hold, citing market uncertainty, loss of income and diminished confidence in future finances as deterrents.

Looking ahead to the remainder of the year, Zoopla’s latest report also identifies two distinct aspects for consideration. First is how many of the 373,000 stalled sales will make it to completion. Second is how much the demand for homes holds up and how much of this pent-up demand converts into new sales.

Commenting on the findings of the latest UK Cities House Price Index, Richard Donnell, Director of Research & Insight at Zoopla, said: “The scale of the rebound in demand for housing is welcome news for estate agents and developers.

“The COVID crisis and 50-day lockdown have created an unexpected one-off boost to housing demand. Millions of UK households have spent a considerable amount of time in their homes over the lockdown period and missed out on hours of commuting. Many households are likely to have re-evaluated what they want from their home. This could well explain the scale of the demand returning to the market. We need to see more supply come to the market to satisfy this demand.”