Property Investment

‘Build-to-Rent’ is Drawing Investors Away from Buy-to-Let

New-build homes are attracting rental premiums of up to 41 per cent with the build-to-rent sector drawing investors away from the traditional buy-to-let route, new research has found.

The new-build rental industry is booming thanks to the evolution of the build-to-rent concept, which provides tenants with a considerably higher quality of rental property while emphasising quality of life and modern-day amenities that attract today’s renters.

In fact, the number of build-to-rent developments under construction climbed by 8 per cent in the last year, while completions increased by 26 per cent.

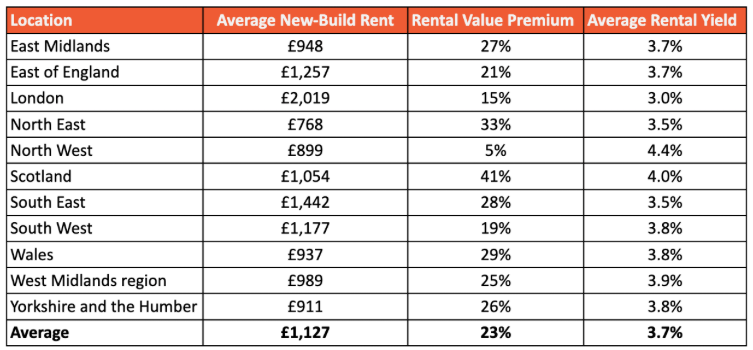

According to the findings, the average rental value of a new-build property across Britain is 23 per cent greater than that of existing properties on the market.

The research has also revealed that Scotland is the region with the largest new-build rental premium, with new homes commanding 41 per cent more in rental revenue, while the North East (33%), Wales (29%), the South East (28%) and East Midlands (27%) also rank amongst the regions with the highest new-build rental premiums.

However, it’s the North West that is currently home to the highest average new-build rental yield at 4.4 per cent, which is somewhat higher than the national average of 3.7 per cent.

In terms of yield, Scotland again ranks high (4%), followed by the West Midlands (3.9%), then the South West (3.8%) and Yorkshire and the Humber (3.8%).

The new research by Unlatch, the platform for developers to digitise and accelerate their new-homes sales process, analysed market data on new-build rental premiums and yields and how they differ across Britain, with the results suggesting that new-build homes are a far better option in the long term.

Lee Martin, Head of UK for Unlatch says: “New-build homes command a far higher price in the sales market and this house price premium will impact the initial yield an investor can expect to see compared to an existing home, despite these properties commanding a far higher value where monthly rental income is concerned.

However, they are fast becoming the investment route of choice and this trend is undoubtedly being driven by the Build-to-Rent boom and the increasing demand from tenants for better rental homes with a lifestyle focus.

Of course, there are a wealth of additional benefits that new homes offer investors when it comes to boosting their profit margins. Running costs are considerably lower as new-builds are substantially more energy-efficient and the better level of build quality and compliance means that maintenance costs are also reduced.

The Build-to-Rent proposition, in particular, also offers the opportunity to invest in the rental market but with a more hands-off approach, which can save investors a considerable amount of personal time and money.”

New-build and existing rental market values sourced from PropertyData and HomeLet.

What are your thoughts about the build-to-rent sector? Do you agree that you can charge a premium for new-build rental properties? Let us know on LinkedIn.