Property InvestmentUncategorized

What Does the Latest Interest Rate Hike Mean for Property Investors?

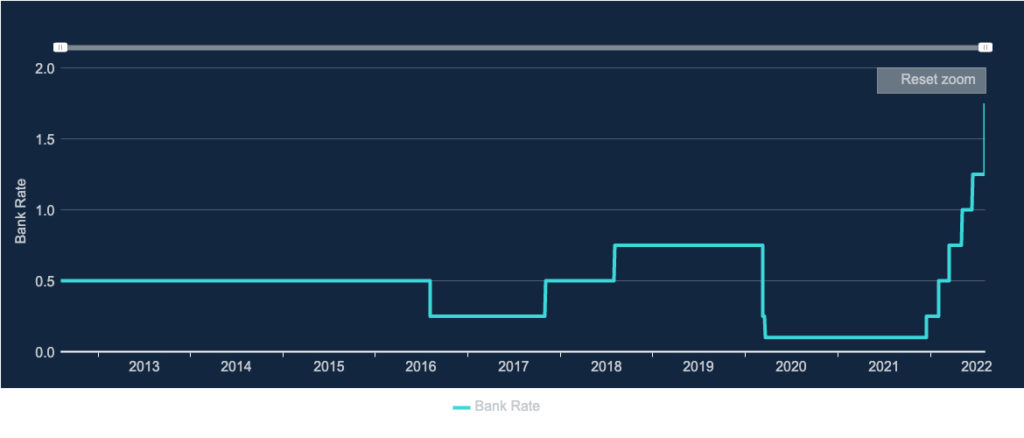

In response to inflationary pressure both in the UK and across Europe, interest rates were increased by 0.5 per cent last Thursday and now sit at 1.75 per cent after the Bank of England’s Monetary Policy Committee voted almost unanimously (by an eight to one majority) to up the Bank of England rate by a highly unusual half a per cent, rather than the more usual quarter of a per cent increment we’ve become accustomed to.

The move has seen interest rates rise to their highest level since December 2008!

The nation’s borrowers have already been feeling the pinch recently due to six 0.25 per cent interest rate increases since December 2021. Added to that, the war in Ukraine has sent utility prices rocketing as Russia controls much of Europe’s stocks of oil and gas; this has had a significant knock-on effect on prices of goods and services worldwide including everyday groceries leading to a cost of living crisis in the UK.

With inflation showing no signs of slowing, the Bank of England has raised its inflation forecast to 13 per cent and now predicts the UK will fall into recession in Q4 of this year.

“In June, prices had risen by 9.4% compared to a year ago. That is well above our 2% target,” the Bank of England’s experts wrote in their Monetary Report for August.

“Higher energy prices are one of the main reasons for this. Russia’s invasion of Ukraine has led to more increases in the price of gas. Since May, the price of gas has more than doubled. We think those price rises will push inflation even higher over the next few months, to around 13%.”

So what does all of this mean for property investors and landlords?

How might rising interest rates affect landlords?

For many years property investors, landlords and homebuyers have benefited from low interest rates.

However, the recent rise in interest rates will almost certainly lead to an increase in lending rates for mortgage holders if they have a tracker mortgage or are on their bank’s standard variable rate. This is because most mortgage lenders increase or reduce their rates in line with the Bank of England rate shortly after the base rate rises or falls.

By contrast, those who have a fixed-rate mortgage will find their mortgage costs will remain the same until their fixed rate period ends.

Should property investors and landlords be worried about recent interest rises?

Here is some data to consider:

-The bank rate is currently sitting at the new level of 1.75 per cent, however, one Bank of England (BoE) forecast shows that the rate could rise to 3 per cent by Q3 of 2023.

-If rates start to rise significantly property investors can also expect the housing market to cool down from the recent boom but, at the moment experts aren’t predicting a crash.

-Although their revised figures show inflation at 13 per cent. BoE experts also believe the UK’s inflation will be back down to its target of 2 per cent in around two years.

-The bank rate has not been over 5 per cent since February of 2008.

-However, some property investors may also remember the 13 and 14 per cent rates of the late 1980s and want to secure an affordable fix for the extra peace of mind it gives.

What action can landlords take to address rising interest rates?

Depending on your situation there will be a number of choices you might want to consider.

For example, if you know you would struggle to afford rates hitting 3, 4, 5 or more per cent and you aren’t on a fixed rate, you may decide to switch onto one as soon as possible.

Even if you are on a low fixed rate at the moment, you may choose to secure a long-term fix (even if at a higher rate) to ensure your costs are future-proofed against unexpected rises for the years ahead.

Karen Noye, mortgage expert at Quilter, explains: “Those on fixed rate deals might still be feeling protected by their deal. However, unless you have recently opted for a long fixed rate deal then it is likely you’re going to need to face the music sooner rather than later when your current deal comes to an end.”

If you are more risk tolerant or are confident these rises will be short-term, you may decide to sit tight and wait it out.

If your mortgage costs increase you may decide to pass on any price rises to your tenants.

Either way, it is probably a good time to make your own assessment of your situation and take some expert advice on how to protect your property portfolio from the predicted rocky years ahead.